QuickBooks Online Receipts vs. Dext, Previously Receipt Bank

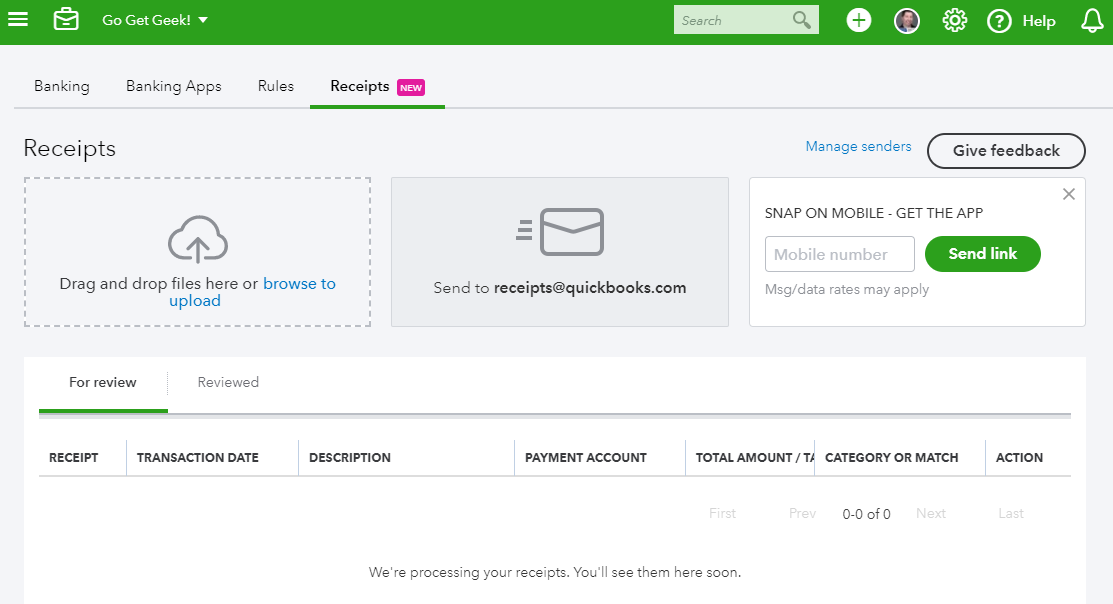

QuickBooks Online (QBO) has a new Receipts tab found via Banking on the left navigation menu. There has already been the ability to attach receipts to transactions in QBO, so you are probably wondering what this new functionality is all about. I have been using Dext for almost a year now, which has been so popular with accountants and bookkeepers, that my guess is that Intuit is trying to capitalize on its functionality.

What functionality does Receipts in QBO currently have?

Since this is a new feature, I will go over what you can do now. I would imagine that additional functionality will be added later with updates.

Ability to drag and drop or browse to upload multiple files. This is convenient for scans of receipts to a computer folder or a great way to attach receipts for catch up bookkeeping, such as when starting a new QuickBooks or switching from another accounting software when transactions are to be added to QBs en masse.

Ability to forward emails with receipts to receipts@quickbooks.com.

Ability to take a photo of a receipt using the app on a smartphone via + (Quick Create) | Capture Receipt.

Ability to extract the date and amount from the receipt after processing, maybe. In my most recent test, QBO didn’t extract anything.

What Receipts in QBO can’t do (yet).

Processing the extraction of the receipt details within 15 minutes. In fact, in my test above, it took even longer, almost up to 24 hours just for 2 receipts.

You can’t choose the email address you want to forward receipts to. This is a big problem if you have more than one QBO account tied to your email address, so this won’t work for ProAdvisors, bookkeepers, or accountants (using QBO Accountant edition) as you can only forward receipts to one QBO account.

You can’t create a free user that only submits receipts. In order for someone to either forward receipts or capture receipts in the app, they have to be set up as a standard user in QBO, using up a billable user and giving them possibly unwanted access to information in QBO.

What is Dext and what is the difference?

Dext was founded in 2010 with global headquarters in London, England. It specializes in Receipt Processing, Accounts Payable Automation, Invoice Processing, Expenses Management, and Bookkeeping efficiency. It has the same basic functionality as QBO Receipts but can do so much more. I will be talking about the features available in a Dext Partner Account, used by accountants and bookkeepers and ProAdvisors like myself to manage multiple clients.

Using a unique combination of AI-powered OCR technology and human verification, documents are translated into data much faster. Uploaded receipts take seconds. In client accounts, I have the option to Boost items’ processing times so I can start working right away.

I can create my own unique email address for forwarding of emails, with or without attachments. This can be shared with anyone I wish that I would like to forward documents but I can also create a unique email address for each user.

I can create as many users that I want, even if they are not users in QBO. A user can just snap a photo of a receipt on the app and submit. You can add the option to allow them to categorize transactions and include customers and classes, if desired, to speed up processing. What is very cool is the ability to show only specific expense accounts in QBO, thus eliminating the risk of errors in classification.

Dext can extract not only the date and amount, but also the payment account used. Most credit card receipts show the last four digits of the card used, which in RB you can associate with the account in QBO.

Dext can extract the vendor (they call it Supplier) and you can create rules that automatically assign the category (expense account) for future items. The only thing I didn’t like (at first) is that the vendor is a required field. I don’t usually recommend adding vendors in QBO for one-off things like gas stations and restaurants. As a workaround, I have catch all vendors such as “Auto” and Restaurants” in QBO to assign these types of transactions. This is also a great way to see all restaurant related expenses in one place, the vendor center in QBO, so this worked out for the better.

Dext can also recognize transactions already in QBO (called Paperwork Match), not just cleared via Banking but also reconciled, and attach receipts to them. QBO can only match to transactions in Banking, so there is the risk of adding duplicates if past transactions were already reconciled. All that is required to publish (send to QBO) is the same vendor name used in QBO.

Dext has an Invoice Fetch feature where you can automatically connect to companies such as Amazon, Best Buy, Home Depot, and many others for retrieval of invoices and receipts. There is also the option to hook up your Dropbox for and PayPal accounts for transaction retrieval and extraction.

Documents are stored (archived) for at least 7 years for IRS requirements. It is also easy to download all of your receipts whenever you want. In QBO, you can only select one at a time (no batch option to download attachments).

How can I get Dext?

Better than the Premium plan, you get unlimited users and unlimited receipt & invoice scans, along with Paperwork Match to add attachments to expenses already in QuickBooks for as low as $40/month.

Update as of 5/18/2020:

I have tested QBO Receipts again. This was the email that I received when forwarding a receipt in the body of an email:

Dext is able to extract this information from the email whereas QBO is only able to work with actual attachments to an email.

And I tried the drag and drop option using a PDF of an emailed receipt. While it was faster at extraction than before (under 15 minutes), QBO still doesn't have the capability of recognizing the payment account from the last 4 digits of the credit card on the receipt:

Update as of 7/7/2020 (QBO Receipts):

You can now create a custom email using a maximum of 25 characters and @qbodocs.com

This has to be created by 10/1/2020 as receipts@quickbooks.com will no longer work after that date.

You cannot change this email later. As long as the email address hasn’t already been created, you can change or create as many email-in addresses as you want in Receipt Bank.

You still cannot forward a receipt from any email address, only those that are set up as users in QBO. With Receipt Bank, you can set up a unique email-in address such as MyCompanyAP@receiptbank.me, which you could give to your vendors just for emailing receipts.