What Are Projects and When to Use Them in QuickBooks Online

Projects is a feature only available in QuickBooks Online Plus, Advanced, and Accountant versions and it is used to track project or job profitability, traditionally referred to as job costing in QuickBooks Desktop.

By default, projects is turned on in QuickBooks Online Plus and Advanced and can be turned off by going to Settings ⚙ | Company Settings | Advanced | Projects and clicking on Edit ✎. Once turned on in QuickBooks Online Accountant, it cannot be turned off.

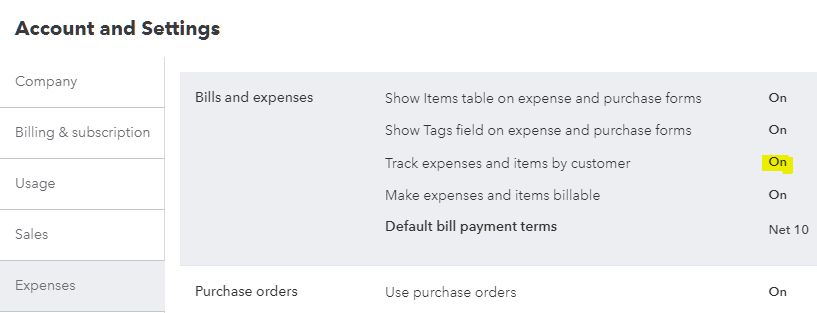

Before QuickBooks Online became as popular as it is today, QuickBooks ProAdvisors, CPAs, and other accounting professionals would tell their clients not to use QuickBooks Online because it could not do job costing. This was not entirely true and probably said because of an aversion to change, loyalty to only desktop products (and/or hatred of anything web-based), or just lack of certification, use, or knowledge of the online version. Whatever the reason, QuickBooks Online always had the ability to create sub-customers, or what are known in QuickBooks Desktop as jobs. In the Plus and higher versions, you can turn on Track expenses and items by customer by going to Settings ⚙ | Company Settings | Expenses and clicking on Edit ✎ and toggling on (green).

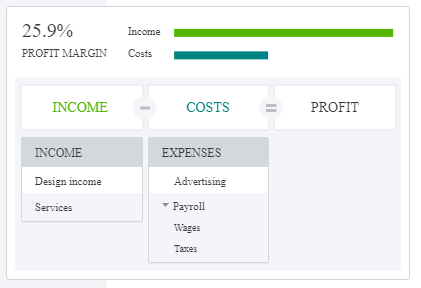

Another reason why QuickBooks Online was not recommended for job costing could be its lack of included job related reports, as found in the the Contractor edition of QuickBooks Premier or Enterprise. However, the inclusion of the Profit and Loss by Customer in QuickBooks Online is sufficient in viewing any job’s or sub-customer’s profitability as related to job income and expenses (checks, bills, expenses, or journal entries with a Customer associated with line item amounts). If this alone is needed, then Projects does not need to be turned on.

So Why Turn On Projects?

Projects is a feature that was added later on, probably due to the misconception or lack of knowledge of using sub-customers and the report as mentioned previously. There is no differentiation between jobs or projects and sub-customers, as existing sub-customers are just converted to projects. Creating a new project just creates a new sub-customer. I have also previously advised against turning on projects because 3rd party apps are not able to use this feature (not accessible via the QuickBooks Online API). While the projects dashboard looks great and does a good job of summarizing project profitability with profit margin, more complex businesses such as construction companies with a lot of employees or service-based contractors use 3rd party apps for estimating, running payroll, and invoicing.

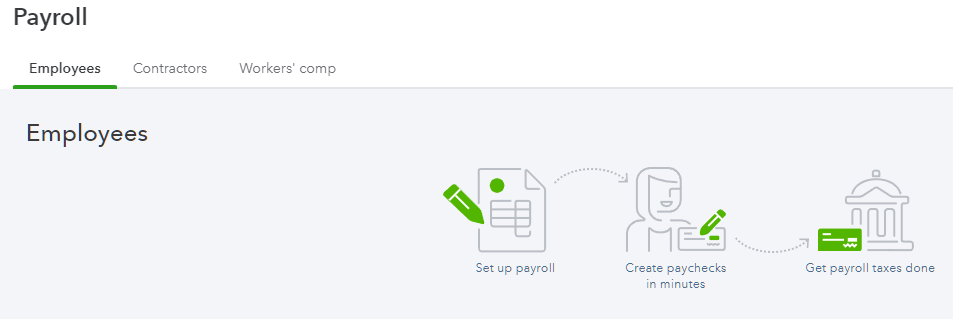

I would only recommend turning on projects if a business needs to track labor costs, especially if already using QuickBooks Online Payroll. Since the acquisition of TSheets by Intuit, now called QuickBooks Time, projects are integrated in this time tracking feature that flows into running payroll. If you don't use QuickBooks Online Payroll, you can still set up your chart of accounts to track your payroll expenses. You'll just have to enter the expenses manually each time you run payroll. I am not a big fan of doing anything manual and this is the only instance were I would not recommend using an outside payroll service.

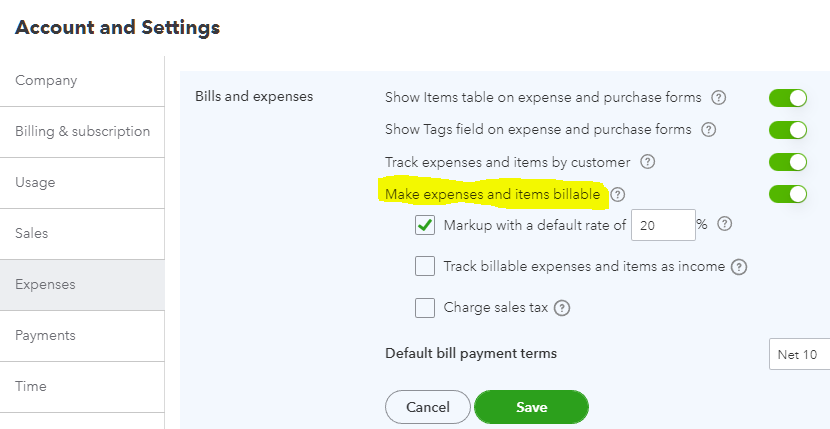

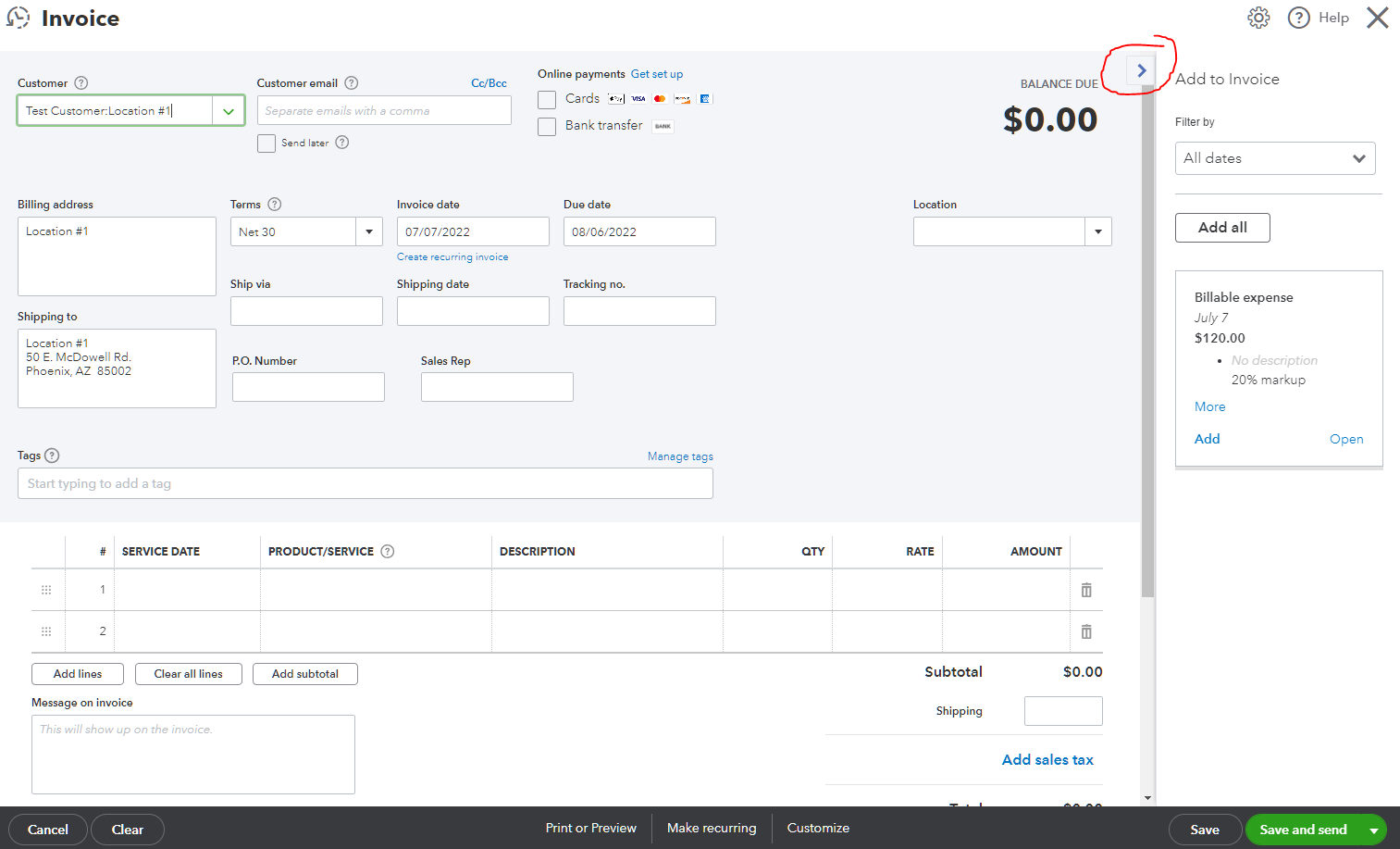

Another reason to turn on projects is if a business needs to automatically mark up expenses when invoicing customers. This is turned on by going to Settings ⚙ | Company Settings | Expenses and clicking on Edit ✎ and toggling on (green) for Make expenses and items billable. For service industries that have to bill all costs to their customers, by turning on this feature, QuickBooks Online will always show unbilled costs in what I call the drawer on the right when creating an invoice. This prevents any cost from being missed that is supposed to be marked up and billed to a customer.

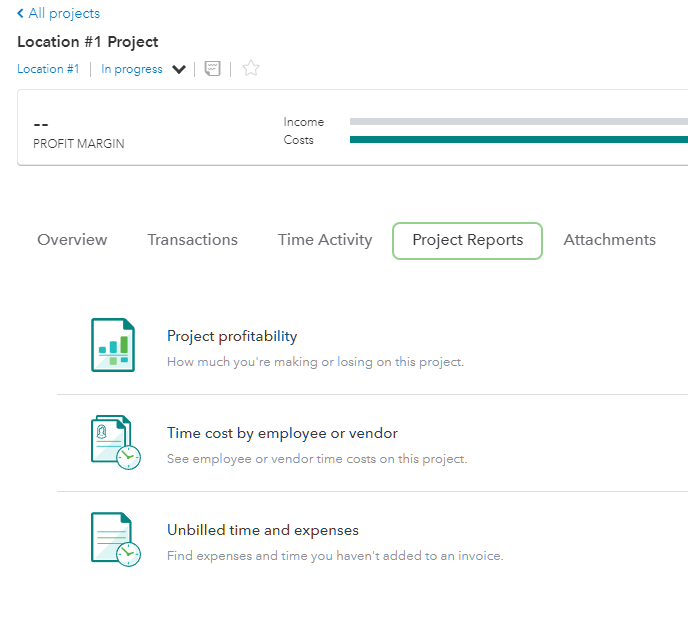

And the tabs within each project help with seeing all project related info including billable expenses in one place without having to customize more general reports.