How to Make a Negative Deposit In QuickBooks: UPDATED

Updated May 4th, 2023: You can now record a negative deposit transaction in QuickBooks Online.

You can’t. From an accounting standpoint, there is no such thing, as a deposit is money added to the checking account. However, refunds to customers, specifically credit card refunds that are batched with charges that are less than the total amount refunded, is pretty common with some credit card processors and Stripe.

Solution

Create a new bank account in the Chart of Accounts called Clearing Account.

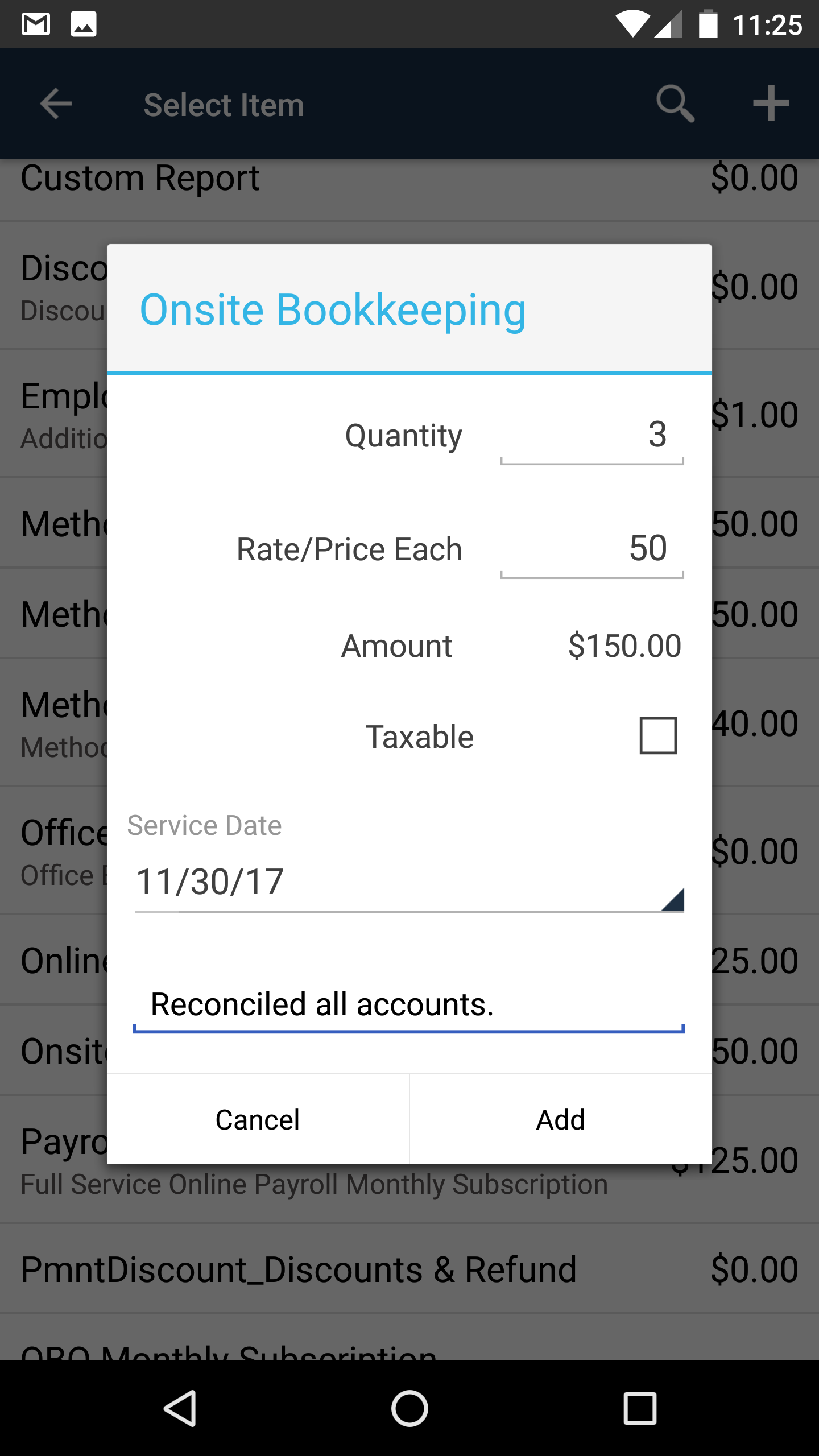

2. Create a new Bank Deposit.

3. Select Clearing Account for the Account.

4. Select refund (negative amount) and any other payments included in the deposit.

5. Under Add funds to this deposit, select the Checking Account under Account and enter the total amount of the deposit as a positive number. The net deposit amount should be $0.00.

6. In Banking, the negative deposit is now a Match.

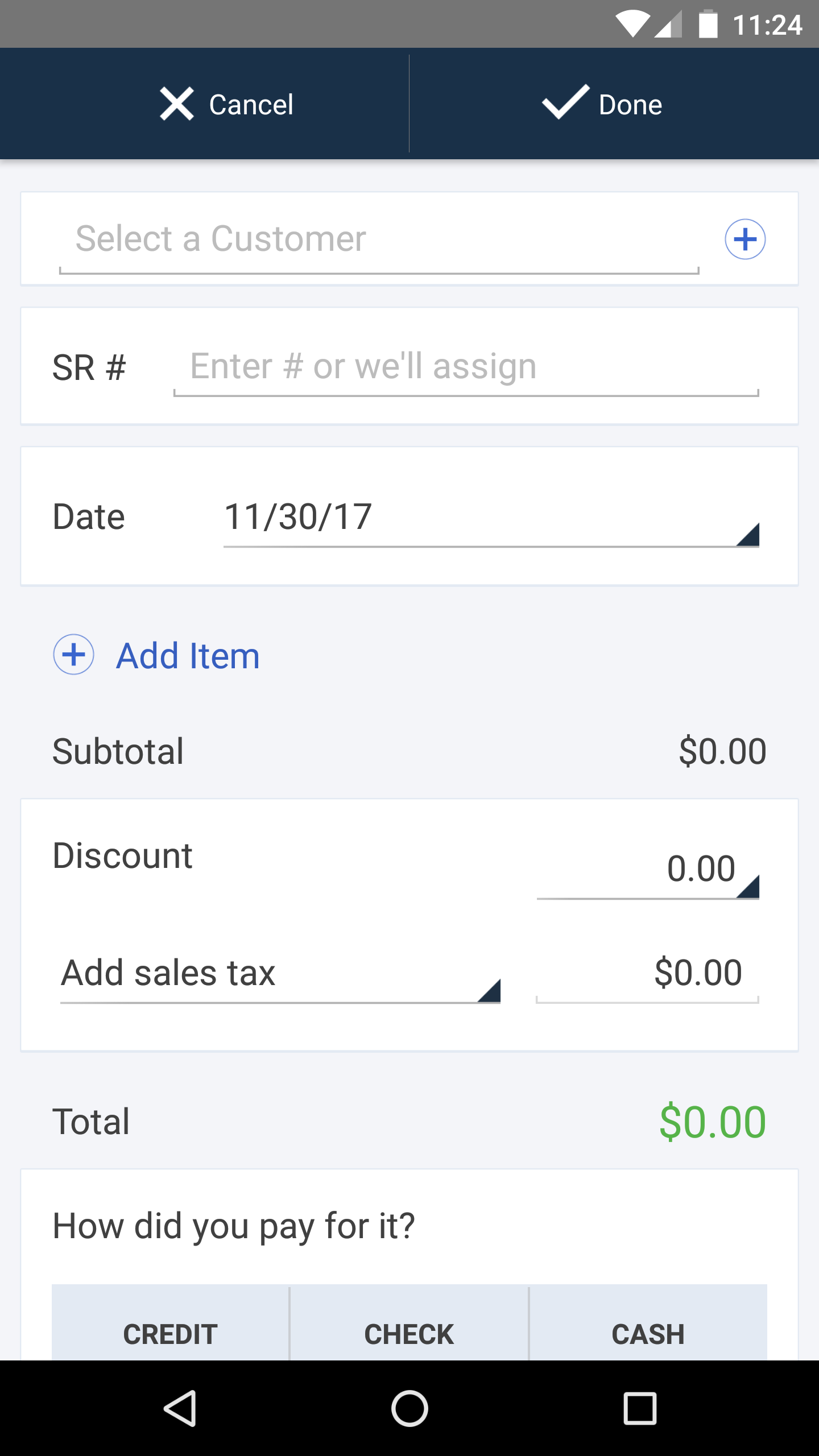

Receive Credit Card Payments Within QuickBooks Online App

Conveniently swipe credit cards within the QuickBooks Online app with a mobile chip reader.

For the last couple of years, I have had to use the GoPayment app to process credit cards, separately from the QuickBooks Online app on my Android phone. For those not familiar with GoPayment, it is the mobile app for QB Payments, a credit card merchant services company owned by Intuit. I have used it for almost as long as my business because I get great rates: 1.6% swiped and 1.75% when clients pay online for invoices that I have emailed out of QuickBooks Online, and it conveniently and automatically records the batch deposits so they are matched perfectly in Banking, where posted transactions are downloaded. And unlike other credit card processors like Square, PayPal, etc., they deposit the full amount of my payments and charge the fees separately, making reconciling so much easier.

Since I also have the QBO app on my Android phone, it was not so convenient having to use the GoPayment app to process credit cards and not have my items synced with QBO. While not a big deal, I also had to import the GoPayment charges into QBO later, and the batch doesn't occur automatically. Now, I don't know if this was solely an issue with my Android phone (I have a Google Nexus 6) or just an app limitation, but I kept getting an error that my mobile card reader, the latest with the chip technology, was incompatible with my device. And when I checked with my colleagues, they confirmed that the app couldn't do it anyway.

But that has all changed! I don't know when it started to work, but I can now process credit cards within the QBO app. This is a total game changer because I can select the products or services already in QuickBooks with pricing, create a sales receipt, and email it off to my client in record time. And the batch is created automatically when the money is deposited into my bank account.

For small businesses that are in a field services industry (Plumbers, HVAC, etc.), this would mean not having to use another app for getting signatures on quotes and receiving deposits or payments, all within the QBO app. Even businesses that do point of sale (POS) transactions (counter restaurants, small shops, etc.), this could work on a tablet to process receipts and eliminate the accounting nightmares that other services like Square, Shopkeep, and Revel would normally cause.

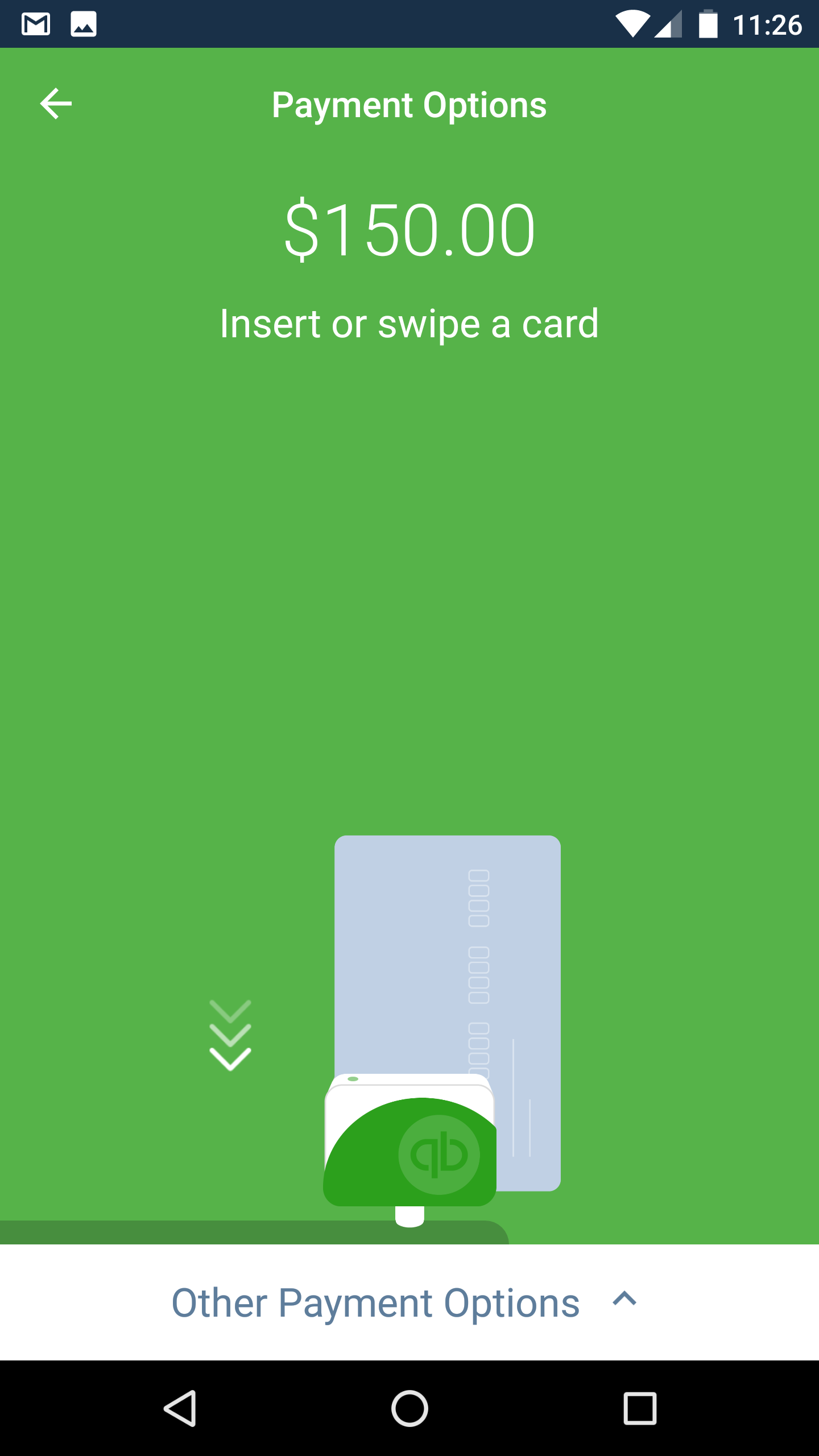

Virtual Terminal Plus: Process Payments on Remote PCs

Using any Web-capable PC and this merchant service tool, you can accept credit cards wherever you are.

We've talked about how

Intuit Merchant Services for QuickBooks

lets you accept credit cards from within QuickBooks. But you can also use your Intuit merchant account to process credit cards from any computer that has Internet access, whether you're at a customer's location or convention or special interest fair. Once you're back at your office PC, you can use this free feature to move sales into QuickBooks and apply them to invoices.

To get started with

Virtual Terminal Plus

, log on to the

and sign in using your Intuit login. On the

Set up payment

page, enter the transaction details (or swipe the card using the optional card reader, $69.95; this will lower your discount rate).

Figure 1: Swipe the customer's credit card using the optional card reader or manually enter the details here.

After the payment is processed and approved, you can print customer and merchant copies of the receipt.

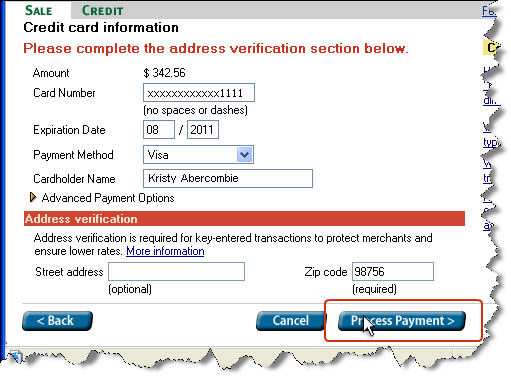

Moving Payments Into QuickBooks

Integration between Virtual Terminal Plus and QuickBooks itself is quite good. Simply open the

Customer Payment

screen from the home page or the

Customers

menu. Under

Manage Payments

in the left vertical pane, click

Get online payments.

The

Intuit QuickBooks Merchant Service

window opens, giving you three options: Recurring Payments, Mobile Transactions and Virtual Terminal Plus.

Figure 2: This window displays payments available to download.

The first time you download completed credit card sales from Virtual Terminal Plus, QuickBooks automatically uploads your customer list to the site (you may want to take this step before you begin making remote sales). New online customers are added to QuickBooks, and the lists are synchronized with every subsequent download.

Then the site displays a list of transactions that have been processed and matches them to outstanding invoices (you can also create an invoice here). To ensure that this setting is correct, click

Edit payment preferences

from the Customer Payment screen. And to see a report of the transactions you've added, go to

Reports | Merchant Service Reports

or

Reports | Customers & Receivables | Online Received Payments.

Simple Tools, Complex Process

If you close sales away from the office, the ability to accept credit cards through Virtual Terminal Plus is likely to increase your receivables. Intuit has made this process easy with its tools and integration, but the overall management of credit card sales should not be taken lightly. We can help you get started and troubleshoot along the way.