QuickBooks Online Sales Tax vs. TaxJar: Which Is Right for Your Business?

Sales tax compliance is one of the trickiest parts of running a business. Between tracking rates across multiple states, keeping up with economic nexus laws, and filing returns on time, many business owners quickly realize they need help. Two popular solutions are QuickBooks Online Sales Tax and TaxJar—but they approach the problem very differently. Let’s break down how each works and which might be the better fit for your business.

QuickBooks Online Sales Tax: Built-In Simplicity

QuickBooks Online (QBO) comes with an automated sales tax engine powered by Intuit’s database. Here’s what it offers:

✅ Pros:

Automatic Rate Calculation: QBO pulls in real-time sales tax rates based on your customer’s location, so you don’t need to manually maintain rate tables.

Nexus Tracking: You can mark which states you collect tax in, and QBO applies the rules accordingly.

Seamless Integration: Since it’s part of QuickBooks Online, there’s no extra software or subscription required. Your invoices, receipts, and reports all tie together.

Basic Reporting: QBO provides sales tax liability reports that help when it’s time to file.

❌ Cons:

Filing Is Still Manual: QuickBooks Online does not file your returns or remit tax payments automatically. You’ll need to log into each state’s portal (or hire someone to do it).

Limited Complex Nexus Support: If your business sells across multiple states or channels, QBO’s tracking can become cumbersome.

E-commerce Limitations: QBO doesn’t directly connect to Amazon, Shopify, or other marketplaces to pull in transactions with marketplace facilitator tax rules.

Best For: Small to mid-sized businesses with sales in just one or a few states, and those already using QuickBooks Online who want a simple, low-cost solution.

Make it stand out

Whatever it is, the way you tell your story online can make all the difference.

TaxJar: Dedicated Sales Tax Compliance

TaxJar is a specialized platform built entirely around sales tax. Acquired by Stripe, it focuses on automating the entire sales tax lifecycle.

✅ Pros:

Multi-State Nexus Management: TaxJar automatically monitors your sales across states and alerts you when you cross economic nexus thresholds.

Automated Filing: With TaxJar AutoFile, the software can submit returns and remit payments on your behalf.

E-commerce Integrations: TaxJar connects with Shopify, Amazon, WooCommerce, BigCommerce, and more—pulling in sales automatically.

Detailed Reporting: Provides clear breakdowns of taxable, non-taxable, and exempt sales by state and jurisdiction.

❌ Cons:

Extra Cost: TaxJar is a separate subscription, so you’re paying in addition to QuickBooks Online. Pricing varies by transaction volume.

Learning Curve: More powerful features can mean more setup and ongoing management.

Separate System: While TaxJar integrates with QuickBooks Online, it’s still another platform to log into and maintain.

Best For: E-commerce businesses, companies selling across multiple states, or those that want fully automated filing and peace of mind.

QuickBooks Online Sales Tax vs. TaxJar: Side-by-Side

Choosing the Right Tool

If you’re a local service business or only collect sales tax in one or two states, QuickBooks Online’s built-in sales tax feature may be all you need. It keeps things simple and doesn’t add extra cost.

If you’re an e-commerce seller or a business with multi-state obligations, TaxJar’s automation can save you countless hours and reduce the risk of missed filings or penalties.

Final Thoughts

Both QuickBooks Online Sales Tax and TaxJar can help you stay compliant, but they’re designed for different types of businesses. The best choice comes down to where you sell, how complex your sales tax obligations are, and how much automation you want.

For many businesses, the sweet spot is actually using both together: QuickBooks Online for your accounting and bookkeeping, and TaxJar for automated sales tax compliance.

How To Record Use Tax in QuickBooks Online for Sales Tax Reporting

Who Pays Use Tax? Well, it depends on the state, but according to Arizona, where I am located:

1. Any person who uses, stores or consumes any tangible personal property upon which tax has not been collected by a retailer shall pay use tax.

2. An out-of-state retailer or utility business making sales of tangible personal property to Arizona purchasers must register with the department for the collection of the use tax.

3. An Arizona purchaser is liable for use tax on goods purchased from an out-of-state vendor that did not collect the use tax. For individual income taxpayers, please see Pub 610A, Arizona Use Tax for Individual Income Taxpayers.

4. Arizona purchasers are liable for use tax if they purchase goods using a resale certificate, and the goods are subsequently used, stored or consumed in Arizona contrary to the purpose stated on the certificate.

5. The use tax also applies to purchases on which another state's sales tax or other excise tax was imposed if the rate of that tax is less than the Arizona use tax rate.

A lot of my clients have inventory and sometimes they will use a product to replace a faulty product or one under warranty for a customer. And since they don't pay sales tax on the purchase of the product, when they consume it they have to pay the state for the sales tax on the cost of the product.

This is how you set up, record, and pay Use Tax in QuickBooks Online.

1. In QuickBooks, click on Sales Tax in the Navigation bar on the left.

2. Click on Add/edit tax rates and agencies and New button.

3. Name it Use Tax and enter your single or combined tax rate information based on your company's local sales tax.

4. Go to the Gear icon, Lists, Products and Services.

5. Click on New to create a new product called Use Tax Income Offset using the same income account used when selling products and uncheck Is Taxable box.

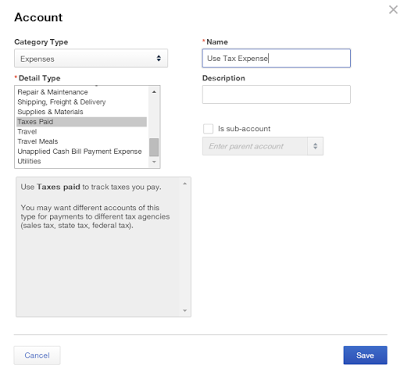

6. Create a new expense account, Use Tax Expense in your Chart of Accounts if you don't already have one.

8. Back in the Products and Services list, create a new product called Use Tax Expense that is not taxable using the Use Tax Expense account.

9. Use a sales transaction (sales receipt or invoice) to record the products used and either use a "house" customer account or the actual customer that it is used for and change the tax rate to the Use Tax rate.

10. Change the rate of the product from the sales price to the cost.

11. Add the Use Tax Income Offset item and put the negative of the cost above.

12. Add the Use Tax Expense item and put the negative of the tax amount below.

13.

This will zero out the Sales Receipt. Save and Close.

14. The Sales Tax Center and Sales Tax Liability report will now show the Use Tax amount due and will be included when you Record Tax Payment.

15. The Profit & Loss statement will now reflect the purchase cost of the product and the use tax expense related to using it and the income account isn't affected.