A Must Have App for Simple and Mobile Inventory for QuickBooks

Inventory is probably one of the biggest challenges for QuickBooks Users. Even for businesses that think they are small and not complicated, the processes involved for tracking purchases, stocking inventory, and maintaining accurate quantities on hand can be a nightmare. Both QuickBooks Online (QBO) and QuickBooks Desktop have inventory capabilities; however, either additional functionality or more efficient processes are needed that neither one can provide alone.

QuickBooks Online

QBO is great for simple inventory control with the added bonus of using the FIFO method for inventory valuation. Currently, this is some of what is missing:

Sales or Work Orders. These transactions are necessary for managing open customer orders, picking and packing, and tracking backorders.

Item Receipts. These transactions are needed to add to the quantity on hand for items received, which may be before a bill is even received.

Multiple warehouses and other locations such as vans or trucks that hold stock.

Bin or Lot Tracking with Serial Numbers and Expiration Dates.

Assembly items.

Barcoding.

I do love the fact that QBO is web-based and that there is a mobile app that can perform a lot of functions out in the field, such as sales receipts with credit card payments. And there are quite a number of 3rd party apps that I have tested that are full on inventory solutions. The problem with almost of all of them, in my opinion, is that they don’t use the inventory in QBO.

HandiFox

HandiFox is the exception. This app uses the inventory in QuickBooks and syncs transactions bidirectionally with it, ensuring accurate financials and correct inventory valuation. Also, the design interface is user-friendly and easy to navigate in both the web-based and mobile app versions. Plus, there is so much more it can do than what I have listed above. And it works with both QBO and QuickBooks Desktop.

QuickBooks Enterprise with Advanced Inventory

QuickBooks Enterprise (QBES) has the most functionality of all QuickBooks products and alone can handle the most complex inventory processes. While there is no mobile app, there is a mobile warehouse app when Advanced Inventory is turned on. This requires the Platinum subscription, which is the most expensive tier of the required subscription. And it is somewhat limited currently as to what it can do. Here is a comparison with what HandiFox can do:

3 Essential Inventory Functions Needed in QuickBooks Online

With the “new” QuickBooks Advanced version I was expecting a slew of new functionality that would really differentiate it from the other versions (Essentials & Plus), instead of just capping lists and increasing users up to 25 (which we had anyway). A lot of businesses track inventory and QBO has this basic functionality. I have been very happy so far with being able to use FIFO valuation, Categories, SKUs, and now Price Rules for products. But more is desperately needed.

Essential Inventory Functions Needed Now

Sales Orders & Item Receipts

We already have the ability to copy from an Estimate to an Invoice in QBO. But we need the ability to have the sales order step in between the two. This will allow reporting on orders in progress and inventory allocated. It will also differentiate between quotes from sales people versus quotes actually turned into customer orders. It should just be as simple as copying the info from an estimate to a sales order and then the sales order can be copied to an invoice. Or course, additional templates will be needed for pick lists and packing slips.

On the purchasing side, we need Item Receipts. Unlike in desktop (except for Enhanced Receiving in QuickBooks Enterprise), these need to be separate transactions from bills, which currently add inventory to QBO. That way, the date of when items are received are retained when copying the info to a bill. And items receipts should post to Inventory Asset and a Received Inventory liability account. Then when converted to a bill, it just moves the dollar amount from Received Inventory to Accounts Payable for just the inventory items received.

Units of Measure

Since most distributors and wholesalers purchase their products in different units than how they are sold, being able to create units of measure conversions for each product is needed. For example, a product may be sold by the each but purchased by the case (of 12). Conversions should be easy to set up, unlike the multiple unit of measure sets that are so confusing in QBs desktop. So when adding a new product, I should be able to let QBO know what the base unit of measure is and what it is called (each, foot, box, etc.) and whether I use it for selling, purchasing, or both. Then, I should be able to create a conversion (case, roll, carton, etc.) and indicate how many of the base units are included. This way, I can show on a customer invoice the number of “each” sold and on a purchase order to a vendor, I can show how many are being ordered in a larger quantity (cases, pallets, etc.). Basic math is all that is needed here for QBO to calculate the Quantity on Hand for each product according the base unit of measure.

Multiple Locations

Controlling inventory requires some sort of organization. Warehouse workers have to know where to put received inventory and when to pick it from. This usually involves labeled sections, rows, bins, etc. Larger businesses may have more than one warehouse or have multiple trucks where they need to know how much inventory is in/on each one. Therefore, there needs to be a way to turn on multiple locations or sites with the ability to add bins or sublocations. Again, just the reporting will break out the total quantity on hand by location.

Currently, there are multiple 3rd-party apps that fill in the gaps of QBO with this functionality. However, the biggest problem I have with them is that they make you turn off inventory in QBO. This means that inventory items may show as Service items in QBO and there is no reporting such as an inventory valuation summary to compare with the inventory asset amount on the balance sheet. My guess is that these apps also sync with other accounting solutions such as Sage and Xero or can just be used alone, thus increasing the revenue reach for their developers. Therefore, they probably don’t want to integrate with just QuickBooks, especially if these features do eventually get implemented in QBO. I would rather have all my inventory in one platform and I am hoping that Intuit sees this as an immediate need to develop into QuickBooks Online.

Part 2: How Do You Know If Your QuickBooks Financial Statements Are Correct?

If you track inventory in QuickBooks, you may already know how challenging it is to set up and maintain correct numbers. Typical for businesses that have over a million dollars worth of inventory or that need additional capital or lines of credit, a correct balance sheet is paramount.

Incorrect setup and erroneous data entry can lead to major problems with the numbers on a profit and loss and balance sheet report.

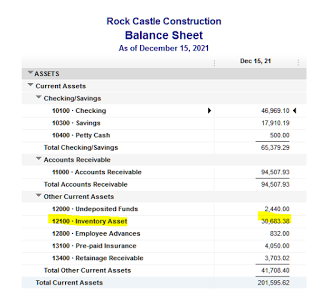

The total for the Inventory Asset account (the one that QuickBooks uses by default with inventory turned on) on the Balance Sheet (on accrual basis) and the Total Inventory at the bottom of the Asset Value column on the Inventory Valuation Summary reports should be equal.

If they don't match, here are some of the possible reasons why:

One or more inventory items were set up with an account other than inventory asset. This would skew the balance on the Balance Sheet. For example, to troubleshoot, go to the Item list | Right click and select Customize Columns and add the COGS Account, Account (Income), and Asset Account. Next, make sure that the accounts for each item is of the correct type. In this example, a COGS type account was used instead of the Inventory Asset account for the asset account.

An expense transaction was entered using the Expenses tab and the inventory asset account.

A journal entry was entered using the inventory asset account. Journals should never be used to change the value of this account; only inventory adjustments should be used to change the quantities and/or values of inventory items.

The two above are harder to troubleshoot to find the discrepancy. Drill down on the inventory asset amount on the balance sheet. Filter by transaction type and select: Check, Bill, Journal. Looking for the amount of the discrepancy also helps, unless there are many transactions that were entered incorrectly.

If you have the accountant version of QuickBooks or have a Certified QuickBooks ProAdvisor, it is much easier to find using the Reclassify Transactions tool. By selecting "Non-Item-Based" for Show transactions, only transactions that used the inventory asset account without using an item will be displayed.