How To Record Use Tax in QuickBooks Online for Sales Tax Reporting

Who Pays Use Tax? Well, it depends on the state, but according to Arizona, where I am located:

1. Any person who uses, stores or consumes any tangible personal property upon which tax has not been collected by a retailer shall pay use tax.

2. An out-of-state retailer or utility business making sales of tangible personal property to Arizona purchasers must register with the department for the collection of the use tax.

3. An Arizona purchaser is liable for use tax on goods purchased from an out-of-state vendor that did not collect the use tax. For individual income taxpayers, please see Pub 610A, Arizona Use Tax for Individual Income Taxpayers.

4. Arizona purchasers are liable for use tax if they purchase goods using a resale certificate, and the goods are subsequently used, stored or consumed in Arizona contrary to the purpose stated on the certificate.

5. The use tax also applies to purchases on which another state's sales tax or other excise tax was imposed if the rate of that tax is less than the Arizona use tax rate.

A lot of my clients have inventory and sometimes they will use a product to replace a faulty product or one under warranty for a customer. And since they don't pay sales tax on the purchase of the product, when they consume it they have to pay the state for the sales tax on the cost of the product.

This is how you set up, record, and pay Use Tax in QuickBooks Online.

1. In QuickBooks, click on Sales Tax in the Navigation bar on the left.

2. Click on Add/edit tax rates and agencies and New button.

3. Name it Use Tax and enter your single or combined tax rate information based on your company's local sales tax.

4. Go to the Gear icon, Lists, Products and Services.

5. Click on New to create a new product called Use Tax Income Offset using the same income account used when selling products and uncheck Is Taxable box.

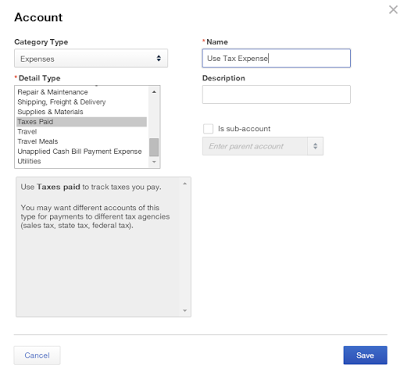

6. Create a new expense account, Use Tax Expense in your Chart of Accounts if you don't already have one.

8. Back in the Products and Services list, create a new product called Use Tax Expense that is not taxable using the Use Tax Expense account.

9. Use a sales transaction (sales receipt or invoice) to record the products used and either use a "house" customer account or the actual customer that it is used for and change the tax rate to the Use Tax rate.

10. Change the rate of the product from the sales price to the cost.

11. Add the Use Tax Income Offset item and put the negative of the cost above.

12. Add the Use Tax Expense item and put the negative of the tax amount below.

13.

This will zero out the Sales Receipt. Save and Close.

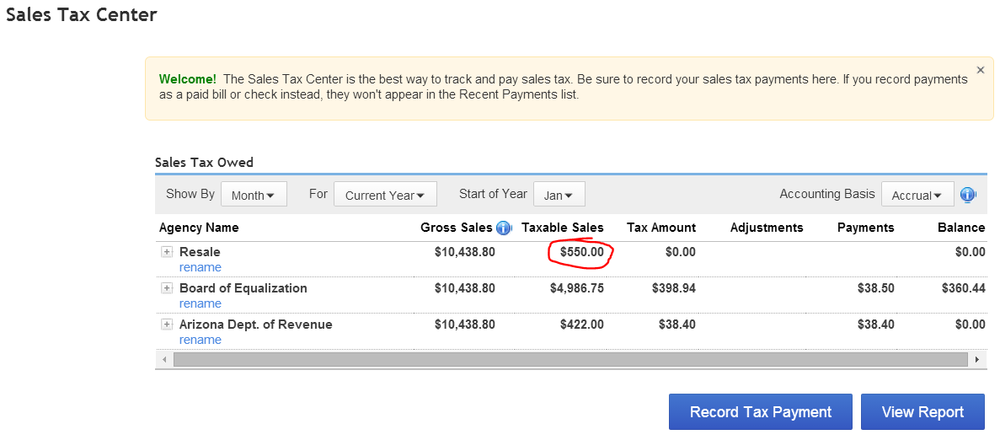

14. The Sales Tax Center and Sales Tax Liability report will now show the Use Tax amount due and will be included when you Record Tax Payment.

15. The Profit & Loss statement will now reflect the purchase cost of the product and the use tax expense related to using it and the income account isn't affected.

How to Track Non-Taxable Sales in QuickBooks Online

Unlike in QuickBooks for Desktop (Windows), there is no Sales Tax Revenue report in QuickBooks Online. Furthermore, you can't have multiple non-taxable sales tax codes. A customer or product/service is either taxable or not based on a checkbox. This can be a problem for small businesses in states such as Arizona that has multiple localities where sales tax is reported separately from the state and non-taxable deductions have to be reported on their forms when filing.

However, there is a solution:

Create a new sales tax item called "Resale" with a zero percentage rate and create a new Agency called "Resale."

For all resale or tax-exempt customers, check the box for taxable and use the Resale sales tax code.

Record the sales receipt or invoice for your customers as you normally would.

In the Sales Tax Center, your resale non-taxable sales amount for the period is now easy to find.

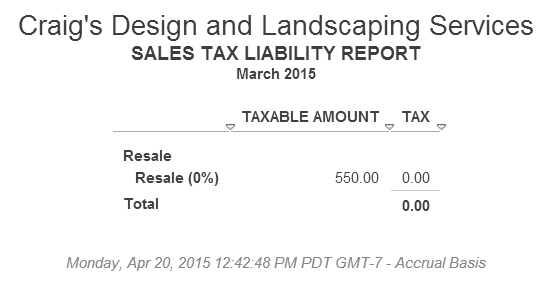

And in the Sales Tax Liability Report:

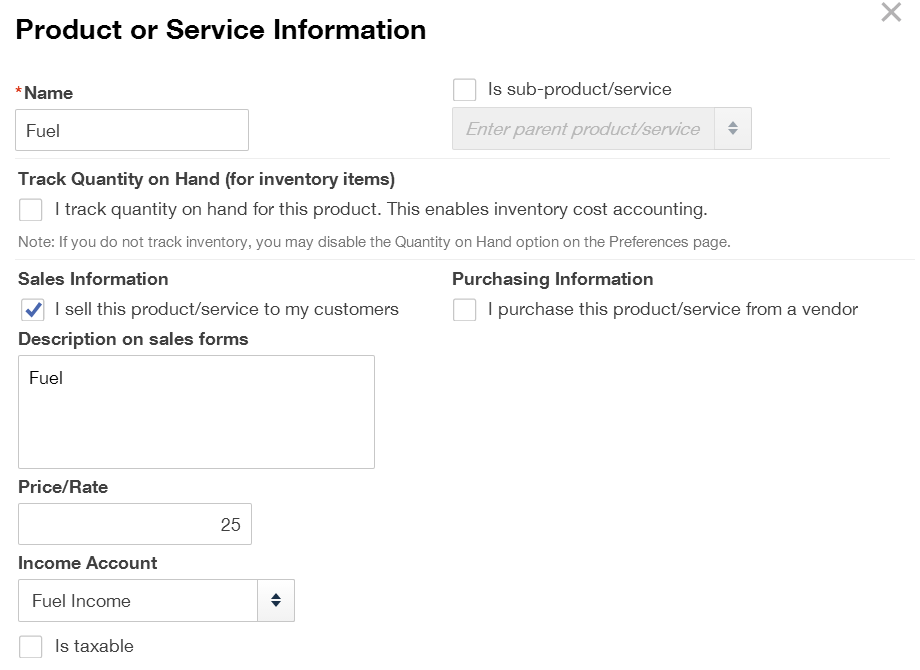

For non-taxable services, such as Labor, or products, such as Fuel or Oil, just create an item that is non-taxable.

Whether the customer is taxable or resale, use the non-taxable products and services on sales transactions.

Run a Report for each non-taxable product and service for the tax period.

Or just run one and customize it by Transaction Date: Last Month and Group by Product/Service (for General), selecting all non-taxable items (for Rows/Columns), and Save Customizations.

Then when working on sales tax, just run this report and use the total amounts for each non-taxable product and service.

It is important that all customers have the taxable checkbox checked so that only the non-taxable products and services will tie in with the non-taxable sales.