Top 10 QuickBooks Mistakes

1. Not Using Undeposited Funds Account

Probably the most common mistake made by QuickBooks users is not using the Undeposited Funds account for payments (or sales receipts). This is an account that is automatically created by QuickBooks. I see this problem occur less often in QuickBooks for Desktop (QBD) than in QuickBooks Online (QBO) because the default preference in QBD is to automatically use Undeposited Funds. However, I still find this unchecked in client files and a big mess, as a result. With it unchecked, payments are deposited directly into the checking account on the date that the payment is recorded. This will cause a headache when trying to reconcile the checking account, as the bank statement will only show the total deposit amount on the day it was deposited, but if there were 2 or more checks and cash included in the same deposit, they will show up as separate items, and perhaps on different days, in the reconciliation. So, you essentially have to be a math wiz to figure out which ones are to be checked that add up to the deposit on the bank statement, which can also add hours to the task.

QBO doesn't have a preference to automatically use Undeposited Funds but rather includes this account in a dropdown of accounts that can be deposited into. However, once it is changed to the checking account, that is what sticks and shows up the next time a payment is entered. I usually only recommend changing it to the checking account if checks are deposited one by one, like what happens when I do mobile deposits (each check can only be deposited separately).

So, the biggest problem I see when using the checking account as the "Deposit to" account for payments, particularly in QBO, is that when the deposit posts and gets downloaded into Banking, it won't show as a match if there was more than one payment in the deposit. And what typically happens is that the user then adds the deposit classifying the amount to an income account. This doubles income already recorded by invoices and overstates income on the Profit and Loss statement. Of course, if not using invoices and payments in QuickBooks, then this is not a problem.

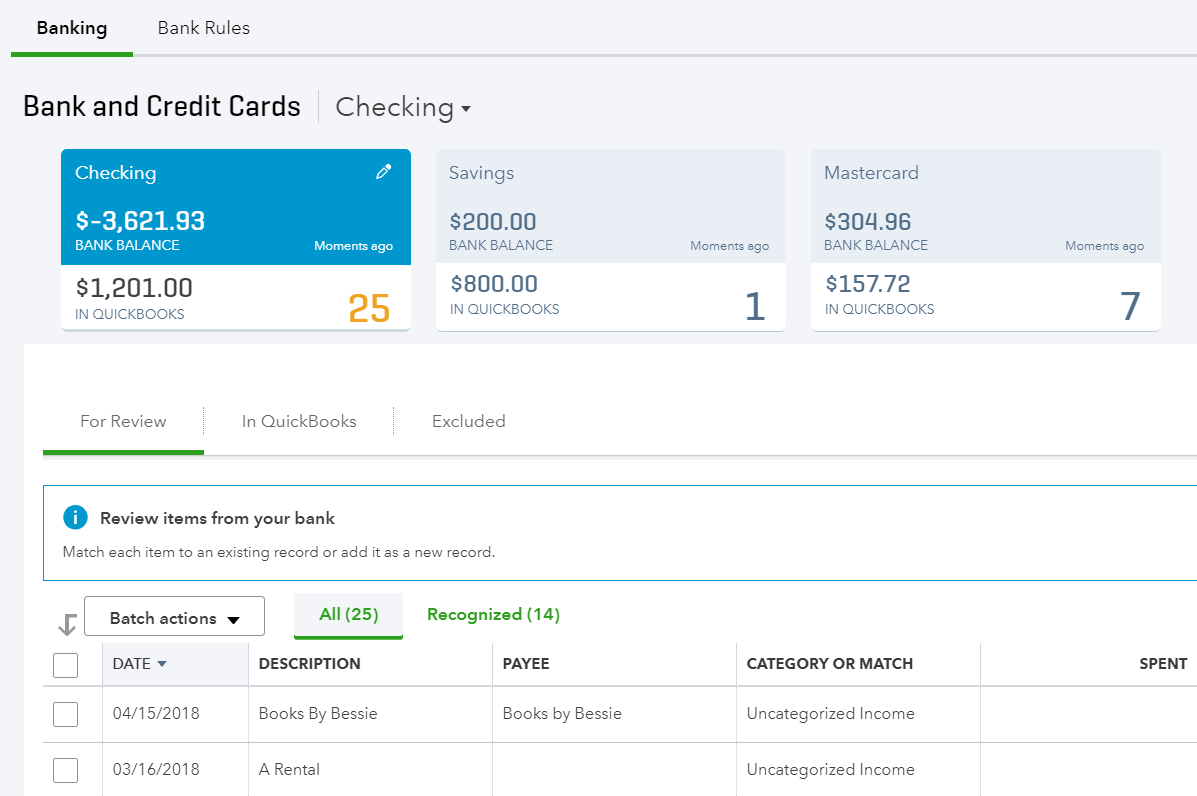

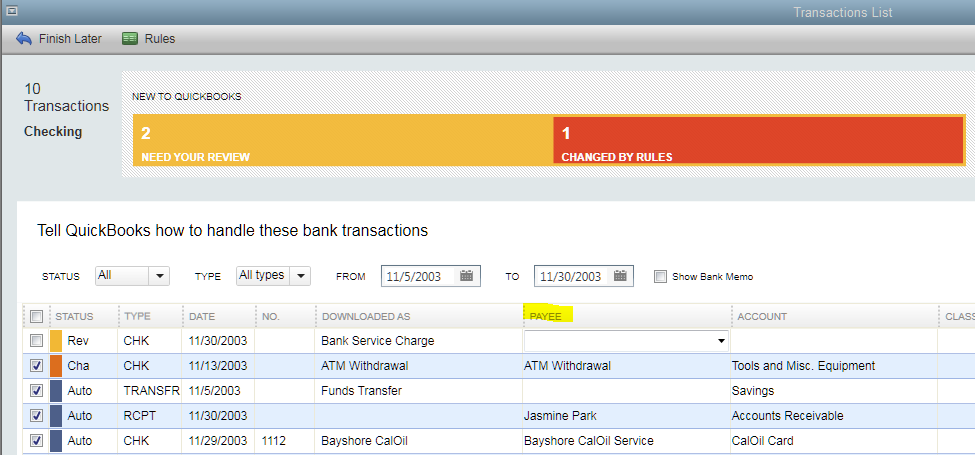

2. Not Using Bank Feeds

It is surprising how many users either just don't know about bank feeds in QBD or don't want to use them. Of course, bank feeds may mean an additional charge from certain banks or may not be available at all as direct connections with some banks and credit cards. This is different from QBO where connecting banks and credit cards in the Banking is at the core of QBO and it doesn't require paying more and is more universally available with most accounts.

Whether in QBO or QBD, the goal is to match anything already entered in QBs or add what is missing. This "clears" each transaction and marks them as tentatively reconciled. The advantage to this is that it makes reconciliations so much easier. In QBO, everything that has cleared gets automatically checked and there is even a cleared date column where transactions that cleared past the statement ending date can be unchecked. In QBD, the reconciliation is not as slick, but at least by downloading transactions into QBs, you won't be faced with trying to figure out why there is a difference due to anything missing. Bank feeds will also confirm if payments and deposits are being done correctly, as in #1 above, as any deposit downloaded into QBs should be a match.

3. Creating Bills for Credit Card Charges

Some users don't even know that you can have a Credit Card type account in QBs. Thus, bills are created off of the credit card statement, with all the charges itemized on the bill. The problem with this, is that from an accounting standpoint, all the charges didn't actually occur on the same day. A better practice is to have expenses occur in the same period as income.

Even if credit cards are in QBs as their own accounts with their respective charges/credits, I blame QBs for even suggesting to create a bill for remaining balances after completing a reconciliation. The problem is that the bill will show in the credit card's register as a payment as of the date of the bill. That doesn't make sense if the bill is paid later and especially with a different amount. Even if you were going to pay all or a portion of the bill, why would anyone create a bill and bill payment, when just a check can be written to pay the credit card. And that brings me to the next most common mistake in QBs.

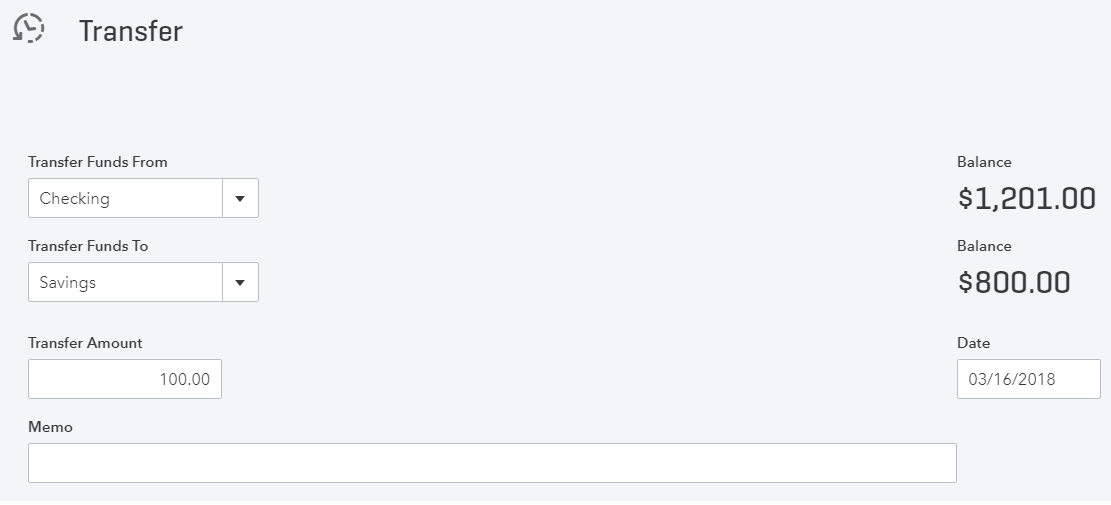

4. Not Using Transfers

Most people like to pay their credit cards using a checking account online. And sometimes both the checking account and credit card are under the same bank and thus the same login. This is what is called transferring funds when making a payment. But even if they are not under the same bank, both accounts should be QBs. Besides writing an actual check and mailing it to the credit card company, any online payment should be replicated by the same transaction in QBs: Banking | Transfer Funds in QBD and Quick Create + | Transfer in QBO.

QBD even has the functionality to initiate the transfer if both accounts are with the same bank. But the biggest problem I see in QBO is that users tend to rely on Banking to bring in their transactions instead of entering everything manually. However, one flaw in QBO tends cause a nightmare in the books. QBO isn't smart enough to know that funds going out of the checking account are connected to funds being received by a credit card account. Therefore, in the checking account, the suggested transaction is an Add (Expense) and in the credit card account, it is a credit card credit. It gets worse if it is between two checking accounts. On one side it suggests it as an expense and on the other side, a deposit. Essentially, what happens is that both transactions are coded to erroneous accounts rather than each other, thus duplicating the same transaction. This creates a bigger problem when reconciling one account and then finding the duplicate in the other account when reconciling. So one has to be deleted and the other, usually re-reconciled or marked with an R in the register. Until QBO gets smarter, I always recommend just creating a manual Transfer transaction the same time the online transfer is made. That way, it just shows up as a match in both accounts in Banking when it posts.

5. Writing Checks for Sales Tax Payments

I don't know why this happens, as QBs even warns you when you try to do this. But I hate pop ups as much as anybody else, so I can see why this could be clicked through, including checking the box so the warning never shows up again (this checkbox should be eliminated).

Unfortunately, QBO doesn't even provide a warning. But at least the Taxes center is very prominent in the Navigation bar on the left.

6. Not Importing Payroll

I am a big fan of using a QuickBooks payroll service, such as Enhanced payroll in QBD, especially since you can do job costing. However, a lot of QBs users are using an outside payroll service, particularly for HR management. Unfortunately, most don't know that services such as ADP and Paychex have an option to export payroll transactions to QBs. These can be in the form of checks and/or journal entries. Without doing this, the actual gross wages as an expense is being underreported if payroll is only represented by the net amounts that go through the checking account.

7. Letting Inventory Go Negative

This has been a problem for years in QBD until Intuit finally included a preference in QuickBooks Enterprise. As ProAdisors, we have been pushing for the software to never allow inventory to go negative. I can understand that this may not be possible for certain business that buy and sell inventory with very short timeframes and thus sales transactions have to come before purchase transactions to get orders out. So, at least having the option to warn instead of blocking makes some sense. But usually preventing inventory from going negative is as simple as using item receipts and keeping the item receipt date for the bill date. My workaround when converting the bill to an item receipt is to just change the bill due date for tracking what bills are to be paid. I don't recommend turning on Enhanced Receiving in Enterprise. This will cause more headaches that it's worth.

From an accounting standpoint and a logical perspective, it is not possible to have negative inventory. Usually, there is a reason why an item has gone negative (samples given out, orders not received in, lost or stolen, etc.) but the implications are important. At least in desktop, going negative has a cumulative effect in that it basically corrupts the data file. This will make it virtually impossible to condense the data file when it gets too big and performance is impacted.

8. Having a Balance in Opening Balance Equity

Opening Balance Equity is an account that is usually used for the setup of a new company file in QuickBooks. As ProAdvisors, we may use this account to hold and track transactions for balances of accounts such as fixed assets, existing inventory, etc. for a balance sheet dated the end of the previous fiscal year. Then, the final transaction is a journal entry to move this balance into Retained Earnings. And finally, we may make this account inactive so it won't be used in any transactions going forward.

However, during the year, users may inadvertently create new items or customers and use the Opening Balance field in the setup of those elements instead of using Invoices, Credits, or Inventory Adjustments. This just puts a balance in the Opening Balance Equity account, which won't make sense having this on the balance sheet.

9. Too Many List Elements

I like to use tax forms as a basis for the accounts to use in QuickBooks. I can understand the need to have multiple income accounts and some subaccounts for expenses. However, I have seen the number of accounts in the chart of accounts get out of control. Some users will create an account for every different type of expense or expense related to a specific vendor. I think this is only due to a lack of understanding how reports can be created/filtered for showing more general expenses broken out by vendor, item, etc.

The same is true for Vendors. It is not necessary to add every expense with a vendor. Maybe this was more common in QBD as in QBO, it shows that the payee is optional.

The vendor list can get pretty large if every restaurant and different gas station is quick added when adding downloaded transactions. I always say to only add a vendor if it is directly related to what the business buys and sells or it is necessary to track spending amounts for reporting purposes.

10. QuickBooks Not Matching Latest Tax Return

This problem I see a lot. Businesses have an accountant or agent prepare their taxes, calculate depreciation of assets, etc. and then the business never receives or enters adjusting entries in their QuickBooks. Or the company file is just not set up by a professional for an existing business and it is never done. Having the balance sheet in QBs match the latest tax return is important for corporations that report a balance sheet on the tax return (1120, 1120S) and need to show carryover balances, but it is really important for all businesses. Banks will usually require a balance sheet for credit line applications and business loans. Once a tax return is filed, I recommend closing the books in QuickBooks for the period ending.

Catch Up or Start a New File in QuickBooks in Record Time

Is your QuickBooks a huge mess? This post is a must read.

As a QuickBooks ProAdvisor, I have seen all of the "disaster" scenarios, including:

A client's computer crashes. The computer's hard drive is toast and they can't recover their QuickBooks Desktop (QBD) company file. To make matters worse, for some reason or another, they don't even have any recent backups.

A client using QuickBooks Online (QBO) connects and syncs transactions from a third party POS app. However, deposits are added to income accounts with more detail via downloaded transactions in Banking instead of matching to imported deposits. A duplication of income and a mess of unneeded transactions persist for months to years.

A client who never used QuickBooks before gets audited by the IRS. All of the sudden, they need years of data in QuickBooks so that correct financial statements can be generated.

While this news is always heartbreaking for me, it is worse for my client having to make the decision to work with an old backup and catch up or start fresh with a new QuickBooks company file. Or for the QuickBooks Online client to decide between fixing existing data or creating a new account, these are not easy decisions to make.

Fortunately, I have tools that can help my clients no matter what recovery plan we agree upon. Using the Bank Feeds in QBD or the Banking center in QBO, the processes of adding hundreds of historical transactions becomes painlessly feasible. However, some banks may only allow downloading 90 days to 6 months or a year of transactions from their online banking websites. Or they may not even offer a .QBO (QuickBooks Web Connect) file download, the only type that can be imported into QBD.

The way around this limitation is to use bank statements, either filed paper statements or downloaded PDFs. These can be converted to .QBO files and imported into QuickBooks. Using bank rules, the process of categorizing and adding transactions can be sped up. And with QBO, you can even have bank rules that

automatically

add hundreds of transactions that match a bank rule.

For more complex cleanup situations, it is possible to delete hundreds to thousands of erroneous transactions. Or it may be necessary to export certain transactions from one account/file, to be imported into another QBO account or combined with another file.

How To Prepare QuickBooks Payroll for Arizona’s New Mandatory Sick Leave Under Prop 206

On November 8, 2016, Proposition 206: The Fair Wages and Healthy Families Act passed. There are two parts to Prop 206: the first is a minimum wage increase, and the second is a mandatory employer-provided sick leave. It is the requirement for private and municipal employers to provide paid sick leave to all employees beginning

July 1, 2017

. Under Prop 206, all employees must accrue paid sick time at a minimum rate of one (1) hour of paid sick time per every thirty (30) hours worked (not confined to a workweek or pay period). Employers with less than fifteen (15) employees, must provide and allow the use of twenty-four (24) hours of paid sick time per year, while employers with fifteen (15) or more employees must provide and allow the use of forty (40) hours of paid sick time a year.

Employers have 2 options to provide these hours to employees:

On an accrual basis (1 hour of sick time accrued for every 30 hours worked).

Front loading 24 hours or 3 days at the start of the calendar year, anniversary date, or 12 month basis.

To Enter the Accrual into QuickBooks Payroll

Starting July 1, 2017, employees will

earn

at least 1 hour of paid leave for every 30 hours worked. That works out to a little more than 8 days a year for someone who works full time. But employers can limit the amount of paid sick leave you can

take

in one year to 24 hours (3 days).

Minimum Accrual Calculation: 1 hr. divided by 30 hrs. = 0.03333 hours.

Hours are accrued per hour worked using the decimal calculation per hour with a maximum allowed number of hours.

Note: The maximum allowed is the maximum hours

at any time.

It does not enforce the yearly limit.

However, if you use a professional time tracking software like

, you can enforce a yearly cap. I highly recommend this software even if you are not using QuickBooks for payroll (works with ADP and other payroll service providers).

To Front Load the Hours into QuickBooks Payroll

Employers also have the option of front loading the 24 hours (3 days) to their employees at the start of the calendar year, anniversary date, or 12 month basis.

Hours are accrued at the beginning of the year.

Hours are accrued on the anniversary date (hire date).

Hours are front loaded for employees.

The accrual method may be the preferred and more accurate way of allowing employees to earn their sick time for businesses that don't already provide a block of sick hours to be used. For those businesses that already have a sick pay policy where hours are not earned until after a tenure of employment (90 days, 1st year of employment, etc.), it may be better to switch to the accrual method. However, it may also be too difficult to track the amount used and stop the accrual beyond the yearly limit since the payroll service doesn't limit by year.

By front loading hours, the employer risks an employee using up their sick hours and leaving employment before actually earning them. However, by giving employees the maximum amount of hours up front, there is no need to keep track of when accrued hours have maxed out, so this is the easiest method to ensure compliance.