Trick to Separate Business from Personal Expenses in QuickBooks

Accountants always say not to mix personal and business expenses. Ideally, small businesses should have a business credit card in addition to a business checking account. However, in this day and age where points, airline miles, and cash back incentives reign supreme, it is hard to resist using certain cards for different types of spend. For example, there may be a card where a minimum total spend for the year qualifies for elite status on an airline and using that card for both personal and business expenses helps reach that milestone faster.

Of course, small business owners want to be careful not to include any personal expenses in business deductions. And misclassifying these transactions in QuickBooks, other than an Owner’s Draw or Loan to Shareholder, can have negative tax implications.

Here’s the trick

Add the credit card account to QuickBooks in Banking, or Bank Feed in desktop.

Exclude all personal transactions that are downloaded.

Pay off the “In QuickBooks” balance in full periodically by making a payment from the business checking account to the credit card account.

Reconcile the account, after the payment posts, to a zero ending balance.

Even if you pay off the credit card in full each month, it is important to pay the business portion separately and then make another payment from a personal checking account for the difference.

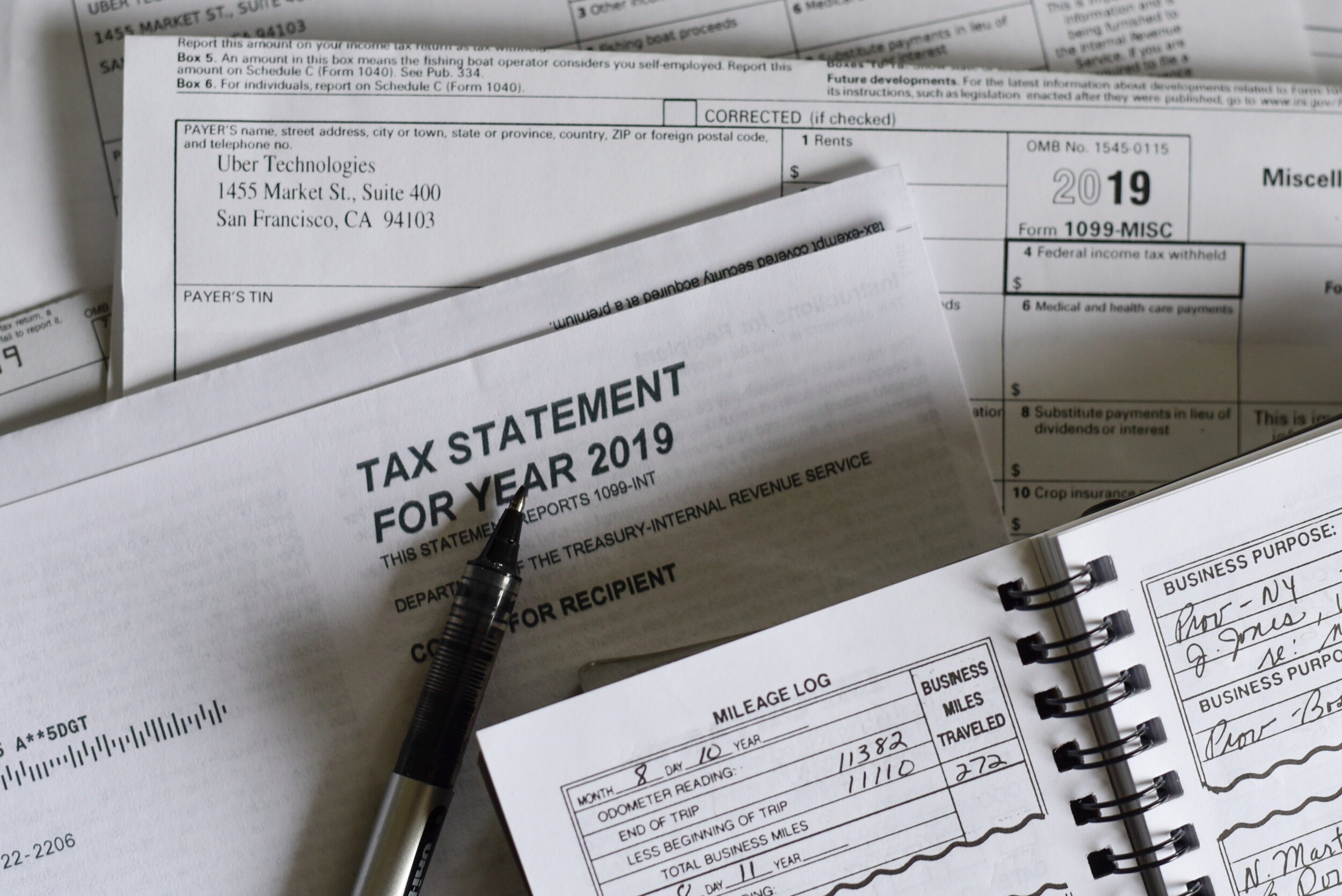

Don’t forget receipts

The IRS requires that receipts for all business deductions be kept for a minimum of 7 years. Unfortunately, most small businesses don’t save receipts and if they do, they are not organized in way that would help in an audit. Ideally, each expense would have a receipt attached to it in QuickBooks so that it can easily be found later. My Bookkeeping Client Portal is not only a great way to achieve this, but it can help in the process of separating business from personal expenses, too.

If You Are Using QuickBooks Desktop, You Must Do This

During these uncertain and unprecedented times, businesses are faced with challenging decisions: staying open and working safely and efficiently. Shutdowns, self isolations, and quarantines make it even more difficult to stay on top of business activities such as accounting, running payroll and keeping track of financials. That is why now more than ever, QuickBooks Desktop users must be able to work remotely and do this:

Host Your QuickBooks

By hosting in the cloud, you are able to access QuickBooks anytime, anywhere. This also eliminates tens of thousands of dollars of IT-related costs managing a local network. QuickBooks Enterprise subscribers already have the option of hosting, but Intuit uses Right Networks, which I have found slow due to shared servers causing QuickBooks crashes and shutdowns. I was also not impressed with their support.

That is why I have been recommending Ace Cloud Hosting for any version of QuickBooks Desktop and other applications such as Office 365. My clients rave about how fast they get set up and how good their support is whenever they need it. Their servers are fast, secure, and reliable.

A Must Have App for Simple and Mobile Inventory for QuickBooks

Inventory is probably one of the biggest challenges for QuickBooks Users. Even for businesses that think they are small and not complicated, the processes involved for tracking purchases, stocking inventory, and maintaining accurate quantities on hand can be a nightmare. Both QuickBooks Online (QBO) and QuickBooks Desktop have inventory capabilities; however, either additional functionality or more efficient processes are needed that neither one can provide alone.

QuickBooks Online

QBO is great for simple inventory control with the added bonus of using the FIFO method for inventory valuation. Currently, this is some of what is missing:

Sales or Work Orders. These transactions are necessary for managing open customer orders, picking and packing, and tracking backorders.

Item Receipts. These transactions are needed to add to the quantity on hand for items received, which may be before a bill is even received.

Multiple warehouses and other locations such as vans or trucks that hold stock.

Bin or Lot Tracking with Serial Numbers and Expiration Dates.

Assembly items.

Barcoding.

I do love the fact that QBO is web-based and that there is a mobile app that can perform a lot of functions out in the field, such as sales receipts with credit card payments. And there are quite a number of 3rd party apps that I have tested that are full on inventory solutions. The problem with almost of all of them, in my opinion, is that they don’t use the inventory in QBO.

HandiFox

HandiFox is the exception. This app uses the inventory in QuickBooks and syncs transactions bidirectionally with it, ensuring accurate financials and correct inventory valuation. Also, the design interface is user-friendly and easy to navigate in both the web-based and mobile app versions. Plus, there is so much more it can do than what I have listed above. And it works with both QBO and QuickBooks Desktop.

QuickBooks Enterprise with Advanced Inventory

QuickBooks Enterprise (QBES) has the most functionality of all QuickBooks products and alone can handle the most complex inventory processes. While there is no mobile app, there is a mobile warehouse app when Advanced Inventory is turned on. This requires the Platinum subscription, which is the most expensive tier of the required subscription. And it is somewhat limited currently as to what it can do. Here is a comparison with what HandiFox can do: