Use QuickBooks Online for Your Simple Point of Sale Solution

Traditionally, a company that sells retail would have QuickBooks for Desktop software and add on QuickBooks Point of Sale desktop software with expensive hardware such as a cash drawer, barcode scanner, and card terminal. With the popularity of QuickBooks Online (QBO), the option has been to either try to add Revel Systems iPad-based system or another cloud-based solution. But these can be technical nightmares getting the right accounting or accurate information to import or sync over to QBO, not to mention the complicated setup (also with the Desktop version).

You don't need very expensive hardware or additional software if you want to have a simple POS solution. I would just use QuickBooks Online, which already has inventory and sales receipt functionality. You can sell products and organize with product categories, SKUs, and price rules.

You can also turn on Locations, which adds a field on forms so you can assign transactions to different locations like stores, trucks, or events.

You can either email the receipt or print it. Being web-based, printing is as simple as printing to any connected printer or downloading a PDF. I'm assuming that since I was able to select whatever paper size that my printer was capable of, then this should work with any thermal printer. By selecting the "Fit to page" setting, I was able to get a full version of my receipt on a smaller footprint.

This solution works best if paired with QuickBooks payments. Unlike using Square or Stripe where the swiped rate can be at least 2.6% + 10¢, with QuickBooks Payments your swiped rate can be as low as 1.5%, and that is for all types of cards including Amex! You also save yourself a major headache because your credit card transactions are batched and the deposit is automatically recorded in QBO. The fees are not subtracted from the deposited amount but are rather charged and recorded separately in your QuickBooks checking account register. These get matched automatically in Banking, making the reconciliation with the bank statement only taking seconds!

Mobile? No problem! Mobile Credit Card Readers work with QuickBooks Online and QuickBooks GoPayment (which also imports payments into QBO if you don't want users in QBO). If you don't want all the sales transaction detail in QBO, then GoPayment would be ideal to import all the payments to a generic Customer in QBO and then just create one invoice for the same customer broken out into the general sales items for the day. Unfortunately, GoPayment doesn't do the automatic batch deposit, so I recommend sticking with just using the QBO app for Android or iOS, which would work great on a tablet.

Again, we just want to keep it simple. One solution, one app.

Update:

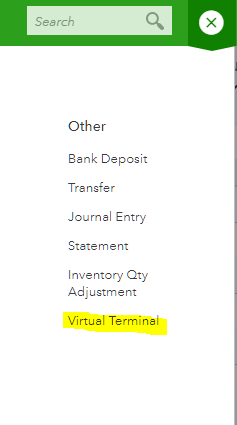

With Virtual Terminal in QBO, it makes it even easier to select items for a sale, just like a traditional POS system for credit card transactions.

The order entry screen is very large and would work really well on a large touch screen, eliminating the need to select items from a dropdown menu. You can also add custom items on the fly for products that are not in your list.

There was a Make a Sale (New) transaction option in QBO, which would have worked for cash transactions, but it disappeared. I am not sure what happened to it (maybe Intuit was testing this feature and pulled it for more development?). Also, I believe the virtual terminal acts like GoPayment where transactions are not automatically recorded and batched into the deposit in QBO.

Top 10 QuickBooks Mistakes

1. Not Using Undeposited Funds Account

Probably the most common mistake made by QuickBooks users is not using the Undeposited Funds account for payments (or sales receipts). This is an account that is automatically created by QuickBooks. I see this problem occur less often in QuickBooks for Desktop (QBD) than in QuickBooks Online (QBO) because the default preference in QBD is to automatically use Undeposited Funds. However, I still find this unchecked in client files and a big mess, as a result. With it unchecked, payments are deposited directly into the checking account on the date that the payment is recorded. This will cause a headache when trying to reconcile the checking account, as the bank statement will only show the total deposit amount on the day it was deposited, but if there were 2 or more checks and cash included in the same deposit, they will show up as separate items, and perhaps on different days, in the reconciliation. So, you essentially have to be a math wiz to figure out which ones are to be checked that add up to the deposit on the bank statement, which can also add hours to the task.

QBO doesn't have a preference to automatically use Undeposited Funds but rather includes this account in a dropdown of accounts that can be deposited into. However, once it is changed to the checking account, that is what sticks and shows up the next time a payment is entered. I usually only recommend changing it to the checking account if checks are deposited one by one, like what happens when I do mobile deposits (each check can only be deposited separately).

So, the biggest problem I see when using the checking account as the "Deposit to" account for payments, particularly in QBO, is that when the deposit posts and gets downloaded into Banking, it won't show as a match if there was more than one payment in the deposit. And what typically happens is that the user then adds the deposit classifying the amount to an income account. This doubles income already recorded by invoices and overstates income on the Profit and Loss statement. Of course, if not using invoices and payments in QuickBooks, then this is not a problem.

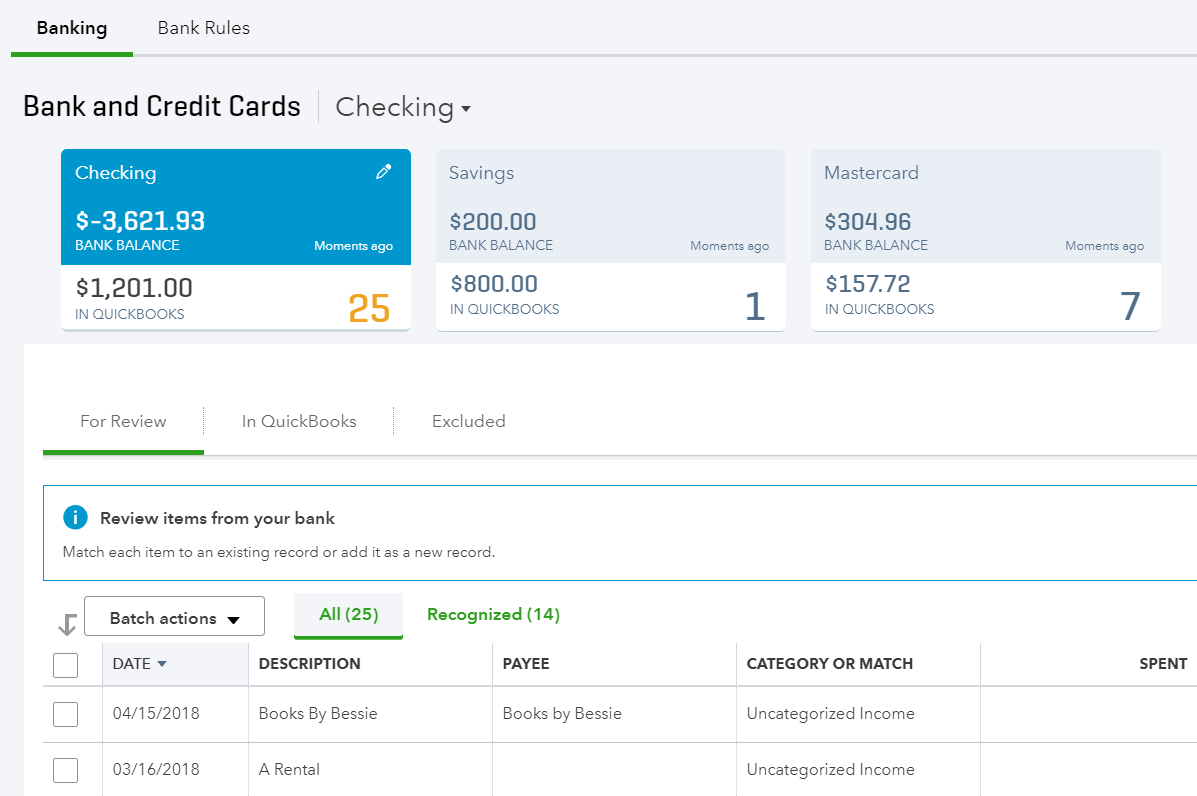

2. Not Using Bank Feeds

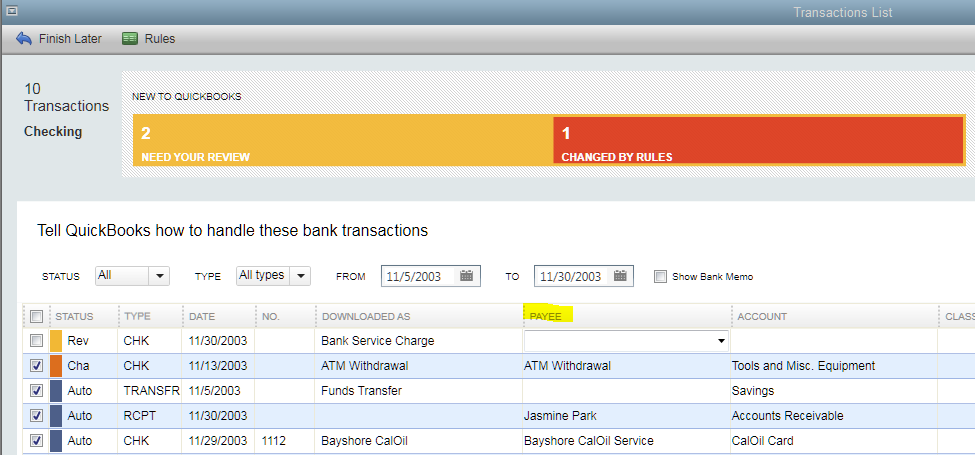

It is surprising how many users either just don't know about bank feeds in QBD or don't want to use them. Of course, bank feeds may mean an additional charge from certain banks or may not be available at all as direct connections with some banks and credit cards. This is different from QBO where connecting banks and credit cards in the Banking is at the core of QBO and it doesn't require paying more and is more universally available with most accounts.

Whether in QBO or QBD, the goal is to match anything already entered in QBs or add what is missing. This "clears" each transaction and marks them as tentatively reconciled. The advantage to this is that it makes reconciliations so much easier. In QBO, everything that has cleared gets automatically checked and there is even a cleared date column where transactions that cleared past the statement ending date can be unchecked. In QBD, the reconciliation is not as slick, but at least by downloading transactions into QBs, you won't be faced with trying to figure out why there is a difference due to anything missing. Bank feeds will also confirm if payments and deposits are being done correctly, as in #1 above, as any deposit downloaded into QBs should be a match.

3. Creating Bills for Credit Card Charges

Some users don't even know that you can have a Credit Card type account in QBs. Thus, bills are created off of the credit card statement, with all the charges itemized on the bill. The problem with this, is that from an accounting standpoint, all the charges didn't actually occur on the same day. A better practice is to have expenses occur in the same period as income.

Even if credit cards are in QBs as their own accounts with their respective charges/credits, I blame QBs for even suggesting to create a bill for remaining balances after completing a reconciliation. The problem is that the bill will show in the credit card's register as a payment as of the date of the bill. That doesn't make sense if the bill is paid later and especially with a different amount. Even if you were going to pay all or a portion of the bill, why would anyone create a bill and bill payment, when just a check can be written to pay the credit card. And that brings me to the next most common mistake in QBs.

4. Not Using Transfers

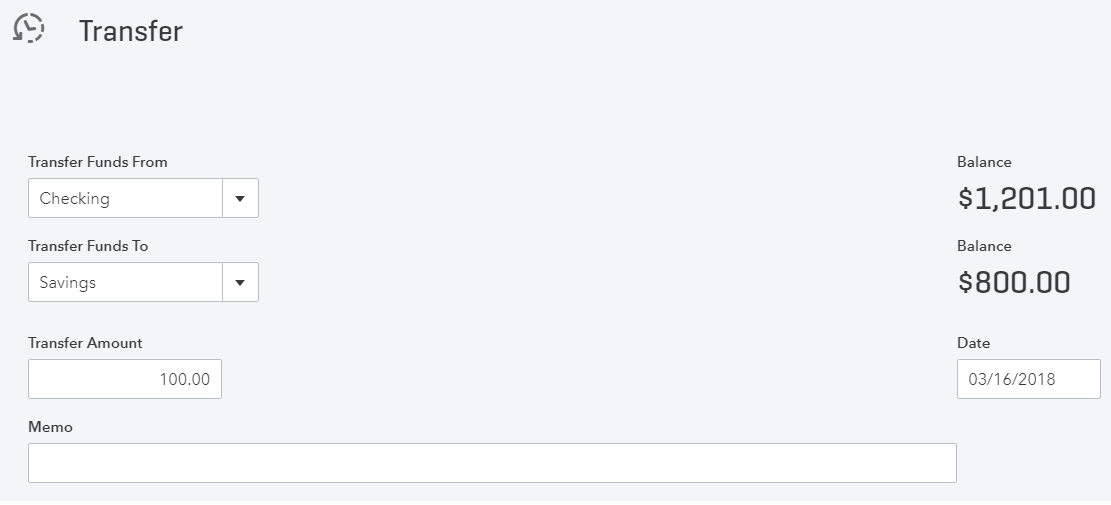

Most people like to pay their credit cards using a checking account online. And sometimes both the checking account and credit card are under the same bank and thus the same login. This is what is called transferring funds when making a payment. But even if they are not under the same bank, both accounts should be QBs. Besides writing an actual check and mailing it to the credit card company, any online payment should be replicated by the same transaction in QBs: Banking | Transfer Funds in QBD and Quick Create + | Transfer in QBO.

QBD even has the functionality to initiate the transfer if both accounts are with the same bank. But the biggest problem I see in QBO is that users tend to rely on Banking to bring in their transactions instead of entering everything manually. However, one flaw in QBO tends cause a nightmare in the books. QBO isn't smart enough to know that funds going out of the checking account are connected to funds being received by a credit card account. Therefore, in the checking account, the suggested transaction is an Add (Expense) and in the credit card account, it is a credit card credit. It gets worse if it is between two checking accounts. On one side it suggests it as an expense and on the other side, a deposit. Essentially, what happens is that both transactions are coded to erroneous accounts rather than each other, thus duplicating the same transaction. This creates a bigger problem when reconciling one account and then finding the duplicate in the other account when reconciling. So one has to be deleted and the other, usually re-reconciled or marked with an R in the register. Until QBO gets smarter, I always recommend just creating a manual Transfer transaction the same time the online transfer is made. That way, it just shows up as a match in both accounts in Banking when it posts.

5. Writing Checks for Sales Tax Payments

I don't know why this happens, as QBs even warns you when you try to do this. But I hate pop ups as much as anybody else, so I can see why this could be clicked through, including checking the box so the warning never shows up again (this checkbox should be eliminated).

Unfortunately, QBO doesn't even provide a warning. But at least the Taxes center is very prominent in the Navigation bar on the left.

6. Not Importing Payroll

I am a big fan of using a QuickBooks payroll service, such as Enhanced payroll in QBD, especially since you can do job costing. However, a lot of QBs users are using an outside payroll service, particularly for HR management. Unfortunately, most don't know that services such as ADP and Paychex have an option to export payroll transactions to QBs. These can be in the form of checks and/or journal entries. Without doing this, the actual gross wages as an expense is being underreported if payroll is only represented by the net amounts that go through the checking account.

7. Letting Inventory Go Negative

This has been a problem for years in QBD until Intuit finally included a preference in QuickBooks Enterprise. As ProAdisors, we have been pushing for the software to never allow inventory to go negative. I can understand that this may not be possible for certain business that buy and sell inventory with very short timeframes and thus sales transactions have to come before purchase transactions to get orders out. So, at least having the option to warn instead of blocking makes some sense. But usually preventing inventory from going negative is as simple as using item receipts and keeping the item receipt date for the bill date. My workaround when converting the bill to an item receipt is to just change the bill due date for tracking what bills are to be paid. I don't recommend turning on Enhanced Receiving in Enterprise. This will cause more headaches that it's worth.

From an accounting standpoint and a logical perspective, it is not possible to have negative inventory. Usually, there is a reason why an item has gone negative (samples given out, orders not received in, lost or stolen, etc.) but the implications are important. At least in desktop, going negative has a cumulative effect in that it basically corrupts the data file. This will make it virtually impossible to condense the data file when it gets too big and performance is impacted.

8. Having a Balance in Opening Balance Equity

Opening Balance Equity is an account that is usually used for the setup of a new company file in QuickBooks. As ProAdvisors, we may use this account to hold and track transactions for balances of accounts such as fixed assets, existing inventory, etc. for a balance sheet dated the end of the previous fiscal year. Then, the final transaction is a journal entry to move this balance into Retained Earnings. And finally, we may make this account inactive so it won't be used in any transactions going forward.

However, during the year, users may inadvertently create new items or customers and use the Opening Balance field in the setup of those elements instead of using Invoices, Credits, or Inventory Adjustments. This just puts a balance in the Opening Balance Equity account, which won't make sense having this on the balance sheet.

9. Too Many List Elements

I like to use tax forms as a basis for the accounts to use in QuickBooks. I can understand the need to have multiple income accounts and some subaccounts for expenses. However, I have seen the number of accounts in the chart of accounts get out of control. Some users will create an account for every different type of expense or expense related to a specific vendor. I think this is only due to a lack of understanding how reports can be created/filtered for showing more general expenses broken out by vendor, item, etc.

The same is true for Vendors. It is not necessary to add every expense with a vendor. Maybe this was more common in QBD as in QBO, it shows that the payee is optional.

The vendor list can get pretty large if every restaurant and different gas station is quick added when adding downloaded transactions. I always say to only add a vendor if it is directly related to what the business buys and sells or it is necessary to track spending amounts for reporting purposes.

10. QuickBooks Not Matching Latest Tax Return

This problem I see a lot. Businesses have an accountant or agent prepare their taxes, calculate depreciation of assets, etc. and then the business never receives or enters adjusting entries in their QuickBooks. Or the company file is just not set up by a professional for an existing business and it is never done. Having the balance sheet in QBs match the latest tax return is important for corporations that report a balance sheet on the tax return (1120, 1120S) and need to show carryover balances, but it is really important for all businesses. Banks will usually require a balance sheet for credit line applications and business loans. Once a tax return is filed, I recommend closing the books in QuickBooks for the period ending.

Price Rules (Levels) Now Available in Beta In QuickBooks Online

A lot of my clients having been using what is known as Price Levels in QuickBooks for Desktop and until now, this has been a deal breaker for those that needed this function in QuickBooks Online. It is important if you have a standard sales price for items, but provide a discounted price for specific items or a fixed percentage or amount that is different for your items for specific customers or all customers. To turn it on, click on the Gear icon, and go to Account and Settings under Your Company, Sales, and click on Turn on price rules and make sure the box is checked.

To set up price rules, go to the Gear icon and select All Lists under Lists, click on Price Rules, and Create a rule button. The following screen will appear.

You can create multiple price rules for different situations.

You may have some customers that pay a lower price for certain services. In this scenario, you would Set sales price or rate by a Custom price per item and put the Adjusted Price in the appropriate boxes.

You can also select specific customers that would get these prices.

You may have a group or a Retail Customer in which all items are marked up by a fixed percentage and you want the all the prices to end in $0.99.

You may want to increase all prices by a fixed amount for all items but only for a specific period such as during a holiday season. This is done by putting in a Start date & End date.

When a sales transaction is created and all the rules are met, then QuickBooks will automatically change the sales price. But by clicking on the rate, you still have the option to change it back to the default sales price.

I think that Price Rules in QuickBooks Online work even better than Price Levels in QuickBooks for Desktop. Since I haven't found any bugs using it, it will probably leave the "beta" status in no time.