The Top 3 Reasons Why QuickBooks Users Shouldn't Use American Express Cards

Since I provide monthly bookkeeping services for many clients, I tend to see the same issues with specific bank and credit card accounts. These issues will show up when reconciling these accounts in QuickBooks. In particular, American Express cards present the most problems and slow me down when working on them. I am not certain if this is only limited to a certain type of Amex card, but here are the top 3 reasons why I don’t recommend that businesses use Amex cards for business expenses.

Charges are missing in QuickBooks. When connecting an Amex credit card in the Bank transactions page, all charges, credits, and payments should download automatically. Unfortunately, I have noticed that some charges don’t get downloaded and I can only find them when reconciling. This can be as random as a few Amazon charges or charges in a foreign currency. This can take a long time trying to figure out which ones on the statement are missing when there are hundreds of transactions in a billing cycle. If it was just one charge, then it would be easy to find it just by searching the PDF for the amount. But that is usually not the case.

Posted charges don’t make the statement. QuickBooks Online automatically checks off transactions with a cleared date that falls within the statement closing date when reconciling, making this process usually fast and easy. However, with Amex, even though charges will clear with a posted date that fall on the statement closing date or even earlier, they don’t make the statement. I’ve had one Amazon charge as early as 10/14 that didn’t even make it on the statement with a 10/17 closing date. With multiple charges at the end of the month, it is not as easy as just unchecking several transactions as there is no rhyme or reason as to which ones make the statement or not. This means that reconciling the Amex account each month will always have a difference until this problem is resolved, which is a pain.

Statements don’t import into QuickBooks. Large banks such as Bank of America, BMO, and Wells Fargo provide the option to automatically import statements into QuickBooks. This makes it very convenient when reconciling these accounts. I have even noticed recently that QuickBooks Online will auto-fill the statement ending balance and statement ending date fields with the data from statements imported from Bank of America. Unfortunately, statements still don’t even import from a large credit card issuer such as American Express. I have to ask every one of my clients to upload their Amex statements to me, which is inconvenient for everyone, unless they provide me with account access.

QuickBooks Desktop Really Is Going Away & QuickBooks Online Pricing Changes

Updated: after September 30, 2024, Intuit will no longer sell new subscriptions of the following Desktop products in the US:

QuickBooks Desktop Pro Plus

QuickBooks Desktop Premier Plus

QuickBooks Desktop Mac Plus

QuickBooks Desktop Enhanced Payroll

What is not changing:

Existing Desktop Pro Plus, Premier Plus, Mac Plus, and Enhanced Payroll subscribers can continue to renew their subscription after July 31, 2024. We will continue to provide security updates, product updates, and support for existing subscribers.

All QuickBooks Desktop Enterprise subscriptions (Silver, Gold, Platinum, and Diamond) will continue to be available for purchase for new subscribers after July 31, 2024. Enterprise Gold, Platinum, and Diamond include integrated payroll.

It is very clear that Intuit is trying to move away from QuickBooks Desktop, except for QuickBooks Enterprise, which has a very large revenue stream. And Intuit has been very transparent regarding their push to QuickBooks Online. Unfortunately, the cost of QuickBooks Online goes up every year, making this a hard decision for QuickBooks Desktop users to switch to QuickBooks Online. While Intuit is continually adding updates and changes to QuickBooks Online, sometimes the changes cause frustration for users having to switch to a new reporting engine and a new invoicing layout.

This is why it is super important for QuickBooks users to submit feedback regarding these changes, including pricing. While I was told by Intuit that submitting feedback in-product weighs the heaviest, I have found this site is active again and also very useful: https://feedback.qbo.intuit.com.

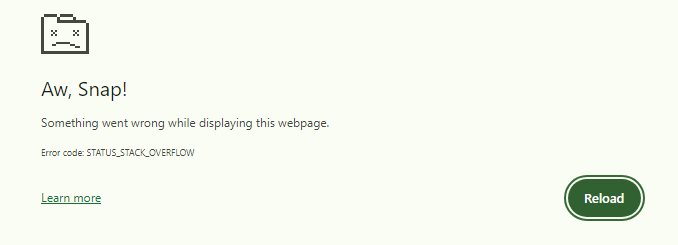

Aw, Snap! Something went wrong when viewing this webpage. QuickBooks Online Reports

Users of QuickBooks Online are getting frustrated when trying to run reports. When creating any report such as the Profit & Loss, QuickBooks Online will crash when trying to change the dates using the dropdown under Report period. Instead, the error message “Aw, Snap! Something went wrong while displaying this webpage” shows up and the report disappears.

Apparently, this is an issue related to a recent update of the Chrome browser, the preferred one to use with QuickBooks Online. And supposedly Intuit is working on a fix. However, in the meantime, short of switching to another browser, there is a workaround.

In the URL of the Chrome browser, go to chrome://accessibility/

This is not the same as going to Settings | Accessibility. On this page above, uncheck the box next to Web accessibility and refresh the page to confirm that it is unchecked. Then, refresh any page already open in QuickBooks Online and run any report. The error should no longer occur when trying to change the dates using the dropdown.