How to Record Prepaid Inventory in QuickBooks Online

A lot of manufactures, wholesalers, and distributors buy their products or materials from China. Along with a purchase order, a pre-payment (or multiple payments), usually in the form of a wire transfer, is generally required before the items are shipped and received.

Here is the process for recording prepaid inventory in QuickBooks Online:

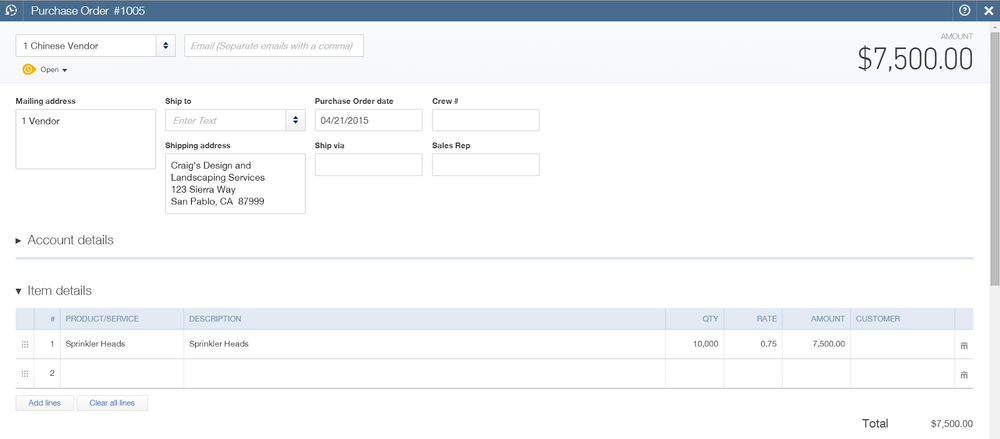

Enter a Purchase Order as you normally would for inventory items.

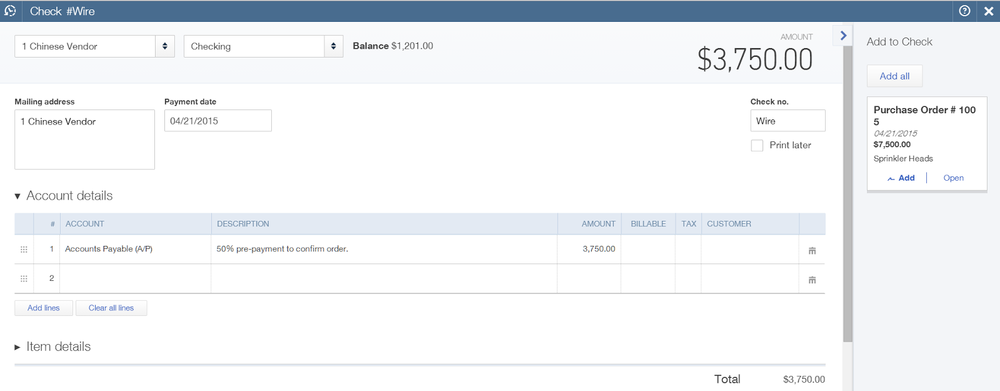

Record the pre-payment as a Check or Expense using Accounts Payable for the expense account.

The pre-payment will now show as a credit for the open balance of the vendor.

When the shipment is received, create a bill from the purchase order.

The remaining balance will now show as the open balance for the vendor.

Make a payment (bill payment).

The bill and the prior pre-payment(s) are checked automatically and the difference, if any, is recorded as a check (or credit card payment).