Intuit Upgrades QuickBooks Payments for Credit Card Processing

Intuit is now going to make it even easier to see and understand the fees associated with QuickBooks Payments, also formerly known as Intuit Merchant Services. Currently, when a credit card payment is deposited to a bank account, you will see a corresponding fee with "BANKCARD DES:DISCOUNT" in the memo. This fee will only be the percentage of the payment as if was a swiped, qualified card, for example. It is not until at the end of month when the credit card statement is generated that any remaining amounts are deducted as one lump "monthly" fee for all payments that are subject to higher percentages, such as mid-qualified and nonqualified corporate and reward cards. This has always been confusing because

a

) the end of the month total fee gets confused with any set monthly fee just for processing credit cards, depending on the plan and

b

) you have to wait until the monthly statement to see what the actual % rates and associated fees for only the

total

payments per discount rate were.

This will all change soon:

You will see new category descriptions for amounts posted to your bank statement.

Intuit Deposit - All deposits for your payments.

Intuit Tran Fee - All transaction fees for payments you accept.

Intuit Account Fee - Any debit or credit to your account related to account fees.

All transaction fees during the month will reflect the actual percentage amounts of your payments as they are posted. There will be no more adjustments at the end of the month.

A simpler, easy-to-read monthly statement. I haven't seen an example of this yet, but I sure hope it will no longer have that faded, courier font like it was produced from a typewriter.

A new number for all voice authorizations: 888-301-3246. I've never had to do a voice authorization so I don't know how this compares to before.

Customer credit card statements will show your business name starting with IN * for payments charged to their credit card.

I always thought that Intuit statements were clearer than other credit card payment processors, who I believe make it very difficult for merchants to compare rates, especially when they tack on so many little fees here and there. And with this upgrade, Intuit will be even more transparent. With the added convenience of being able to process and view credit card payments immediately and have them batched automatically and deposited in QuickBooks, this is just one more reason why I always recommend QuickBooks Payments to my clients.

Virtual Terminal Plus: Process Payments on Remote PCs

Using any Web-capable PC and this merchant service tool, you can accept credit cards wherever you are.

We've talked about how

Intuit Merchant Services for QuickBooks

lets you accept credit cards from within QuickBooks. But you can also use your Intuit merchant account to process credit cards from any computer that has Internet access, whether you're at a customer's location or convention or special interest fair. Once you're back at your office PC, you can use this free feature to move sales into QuickBooks and apply them to invoices.

To get started with

Virtual Terminal Plus

, log on to the

and sign in using your Intuit login. On the

Set up payment

page, enter the transaction details (or swipe the card using the optional card reader, $69.95; this will lower your discount rate).

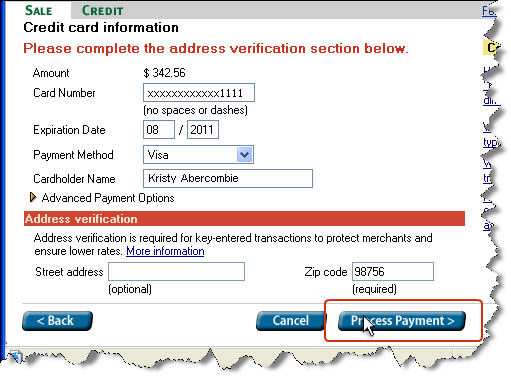

Figure 1: Swipe the customer's credit card using the optional card reader or manually enter the details here.

After the payment is processed and approved, you can print customer and merchant copies of the receipt.

Moving Payments Into QuickBooks

Integration between Virtual Terminal Plus and QuickBooks itself is quite good. Simply open the

Customer Payment

screen from the home page or the

Customers

menu. Under

Manage Payments

in the left vertical pane, click

Get online payments.

The

Intuit QuickBooks Merchant Service

window opens, giving you three options: Recurring Payments, Mobile Transactions and Virtual Terminal Plus.

Figure 2: This window displays payments available to download.

The first time you download completed credit card sales from Virtual Terminal Plus, QuickBooks automatically uploads your customer list to the site (you may want to take this step before you begin making remote sales). New online customers are added to QuickBooks, and the lists are synchronized with every subsequent download.

Then the site displays a list of transactions that have been processed and matches them to outstanding invoices (you can also create an invoice here). To ensure that this setting is correct, click

Edit payment preferences

from the Customer Payment screen. And to see a report of the transactions you've added, go to

Reports | Merchant Service Reports

or

Reports | Customers & Receivables | Online Received Payments.

Simple Tools, Complex Process

If you close sales away from the office, the ability to accept credit cards through Virtual Terminal Plus is likely to increase your receivables. Intuit has made this process easy with its tools and integration, but the overall management of credit card sales should not be taken lightly. We can help you get started and troubleshoot along the way.

Speed Up Receivables Using Intuit Payment Network

The last few years have probably taken a toll on your accounts receivable. A bad economy can result not only in slow sales, but in slow customer payments.

Make it easy for your customers to pay, and it's likely they'll pay faster. You can accomplish this simply and cost-effectively through the

Intuit Payment Network

.

If you're using QuickBooks 2010 or later and are willing to spend 50 cents per payment received to get that money in your bank account faster, consider

electronic invoicing

.

Readying QuickBooks

When you

for the Intuit Payment Network (no setup fee or monthly charges), you'll be able to include a link in your invoices that takes customers to a secure site where they can enter their bank account or credit card information to pay the invoice.

First, though, make sure that QuickBooks is set up for this service. Go to

Edit | Preferences.

Click on

Payments

, then the

Company Preferences

tab. Check the two boxes below

Enable online payment via Intuit Payment Network

and enter the email address that you want to use (only the administrator can activate these preferences).

Figure 1: Make sure that QuickBooks is set up for electronic invoicing.

Just like online banking

Once you've completed this and Intuit has notified you that your account is active, the rest is equally easy. When you create an invoice, the box in the lower left of the screen next to

Show online payment link on invoices

will be checked. Just fill out the invoice like you normally would and save it.

When you send these invoices, they'll include a short paragraph telling customers that they can remit payment online, with a link taking them to the web page:

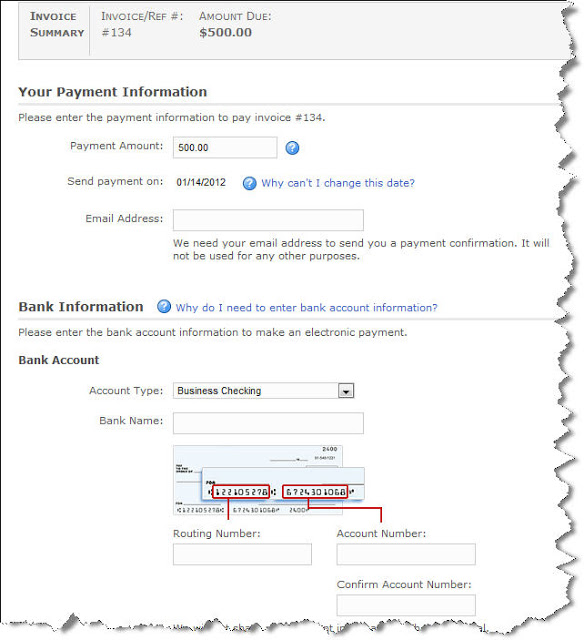

Figure 2: Customers who pay bills online will recognize this process.

Once customers transmit their payments, the funds will move into your bank account within a day or two, minus the 50-cent service charge on bank account payments or 3.25 percent of the transaction amount for credit cards. QuickBooks versions differ on the process for updating your file.

Intuit offers numerous ways to accept payments on your PC or mobile device. We can help you select the right one(s) and get your cash flow moving in a more positive direction.