Beware: New Banking Page in QuickBooks Online Confuses

New Banking Page

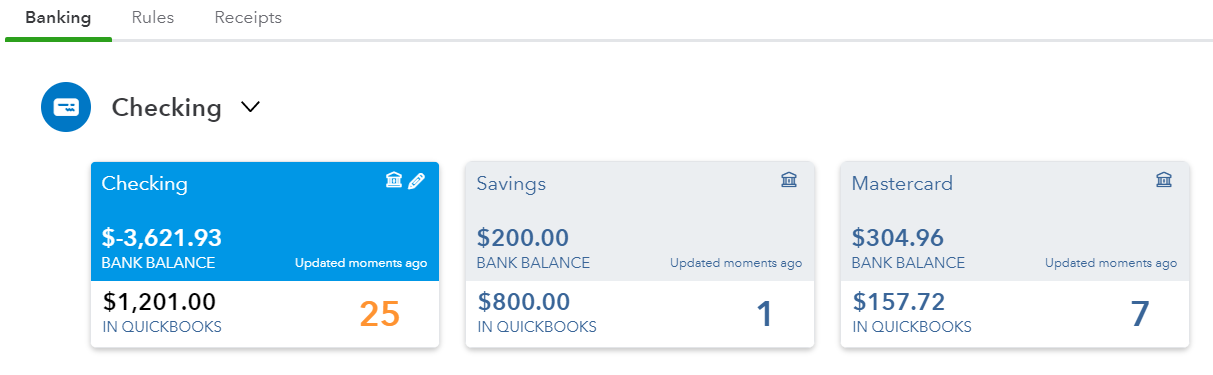

What has changed

A couple of my clients have pointed out to me recent changes in their QuickBooks Online accounts that is causing confusion and dissatisfaction. Apparently, Intuit changed the look of their Banking page. Unfortunately, as a QuickBooks ProAdvisor, I was not made aware of this update and I participate in the monthly In The Know webinars on QuickBooks Online Updates.

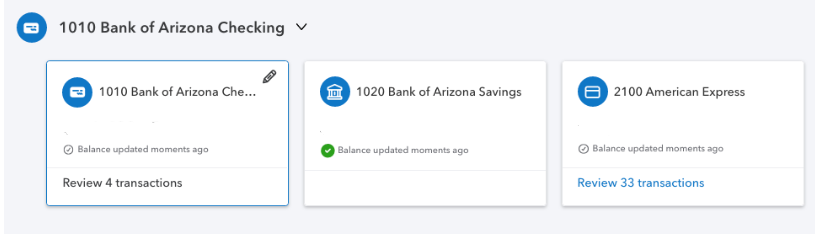

Old Banking Page

First off, the look of the bank and credit card tiles has changed. The font is a lot smaller; it is so much harder to read. What I have always loved about QBO over QuickBooks Desktop is the use of large fonts, so this is an unwelcome change.

The active tile is just outlined in a thin blue line instead of the having the Bank Balance info highlighted in blue.

The number of transactions to review is much smaller.

There is no differentiation between the In QuickBooks balance and the Bank Balance. It is not clear which balance is even being displayed here.

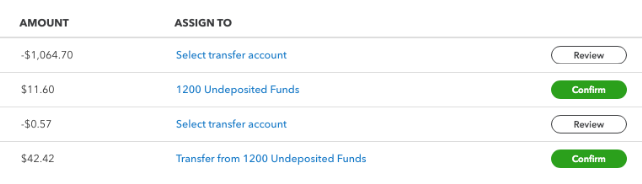

New For Review Grid

Seconly, under the tiles in the For Review section, there have been significant changes, too. While I like the bigger buttons in the Action column (notice how the column title has been removed), their new titles are confusing. The Confirm button especially will cause problems because the Assign To account suggested by QBO is probably wrong. The first reaction is to just click on this button when in reality, the downloaded transaction should be reviewed. I believe the Review button is suggesting an account previously used when adding a downloaded transaction. Both the Review and Confirm buttons really require the same actions from the user: to click and review the correct account, previously known as Add.

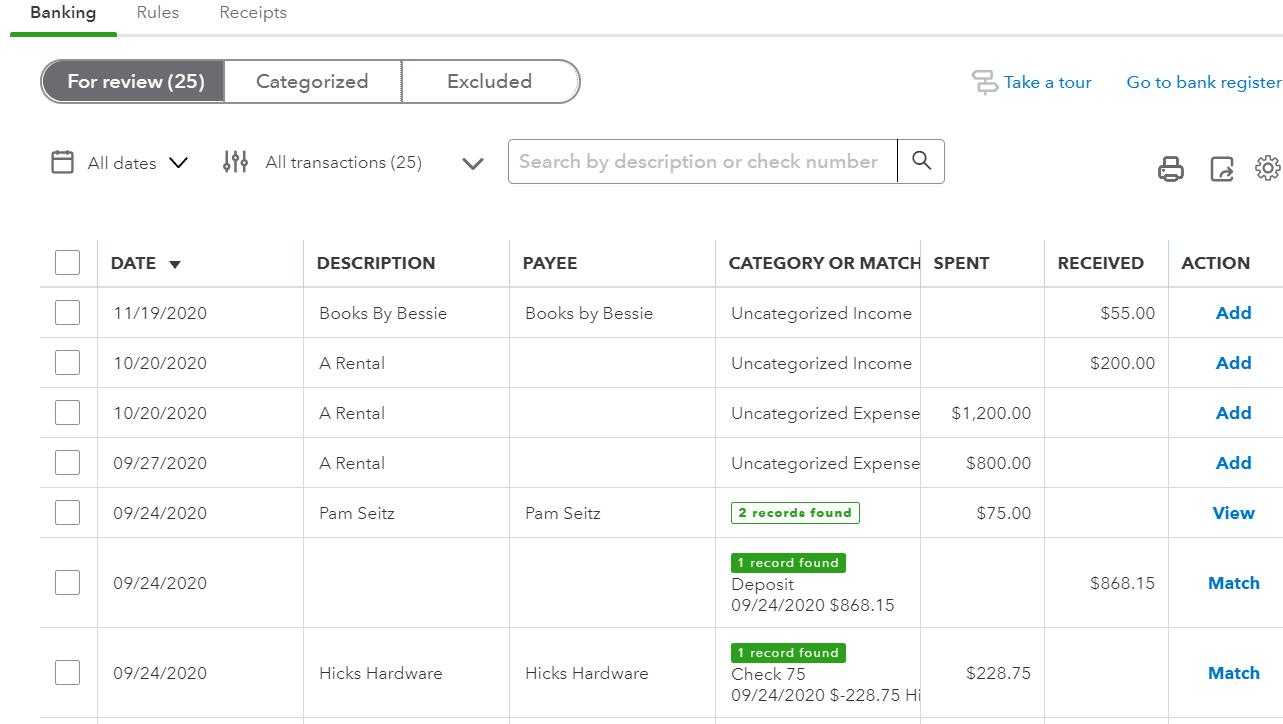

Old For Review Grid

Match has glaringly changed too. It has been replaced with the Review button with the number of records found under Category Or Match column, but not highlighted or outlined, making it easier to miss. The word Match made more sense because it confirmed that only one transaction already in QBs matches the one downloaded from the bank or credit card. The old action View meant that there was more than one transaction already in QBs and that you have to click on the transaction to view the drawer that shows the list of transactions that are potential matches to select from.

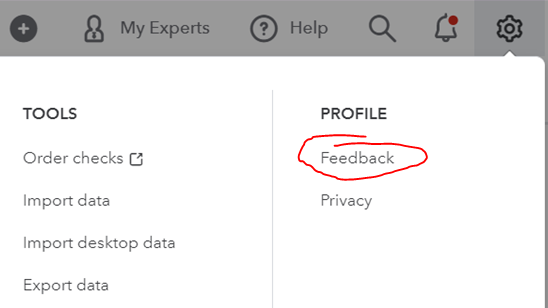

What you can do

It is not clear whether these are temporary changes or test situations imposed on a select group of accounts or indications of what updates are coming for all QBO accounts. If the latter, I suggest that all QBO users submit feedback to prevent these changes from being implemented. This can be done via the Gear icon and Feedback under Profile. For those accounts that already have these changes, I suggest submitting feedback also so that these updates get rolled back to the older version. Intuit takes feedback submitted this way very seriously.

How to submit feedback

Trick to Separate Business from Personal Expenses in QuickBooks

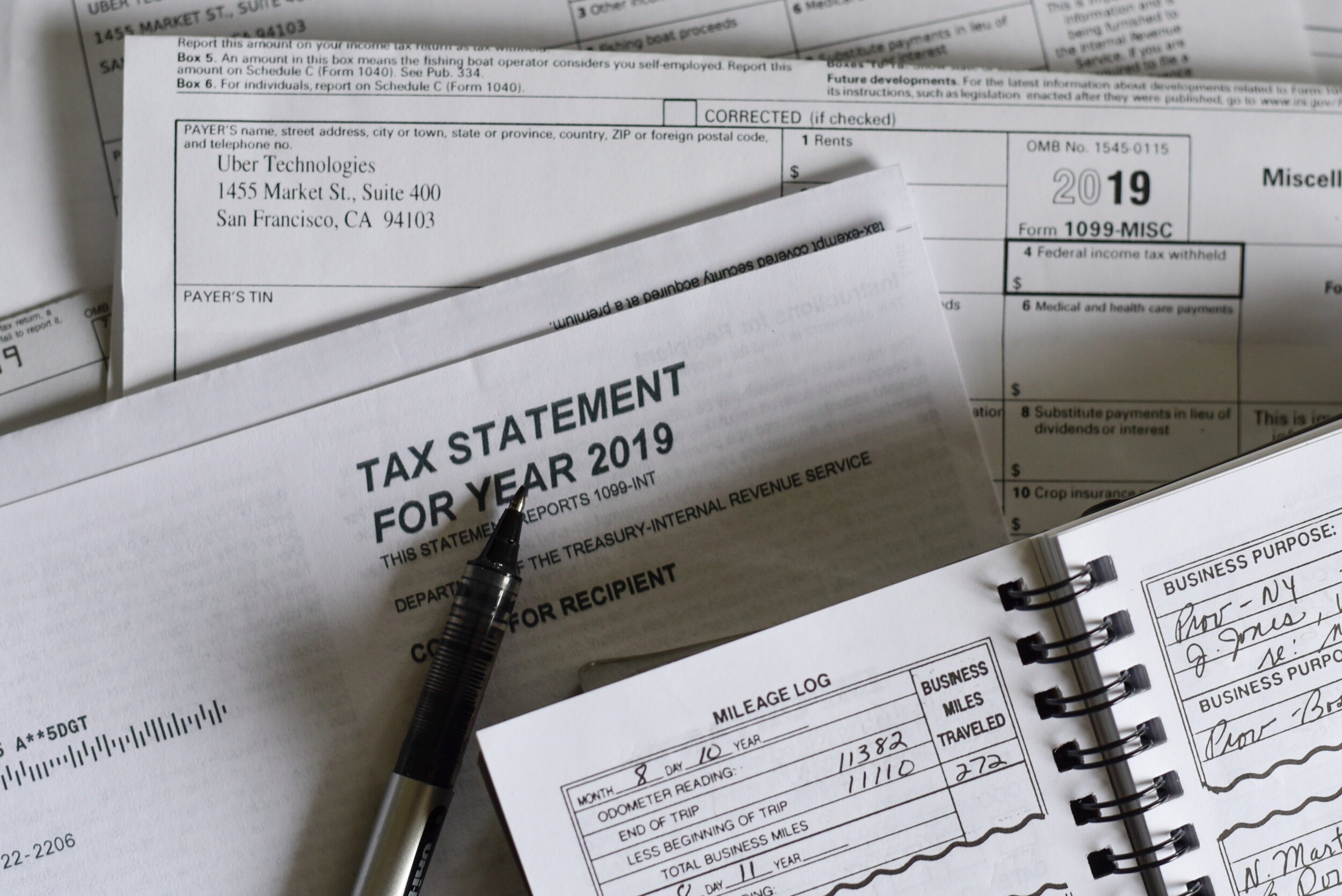

Accountants always say not to mix personal and business expenses. Ideally, small businesses should have a business credit card in addition to a business checking account. However, in this day and age where points, airline miles, and cash back incentives reign supreme, it is hard to resist using certain cards for different types of spend. For example, there may be a card where a minimum total spend for the year qualifies for elite status on an airline and using that card for both personal and business expenses helps reach that milestone faster.

Of course, small business owners want to be careful not to include any personal expenses in business deductions. And misclassifying these transactions in QuickBooks, other than an Owner’s Draw or Loan to Shareholder, can have negative tax implications.

Here’s the trick

Add the credit card account to QuickBooks in Banking, or Bank Feed in desktop.

Exclude all personal transactions that are downloaded.

Pay off the “In QuickBooks” balance in full periodically by making a payment from the business checking account to the credit card account.

Reconcile the account, after the payment posts, to a zero ending balance.

Even if you pay off the credit card in full each month, it is important to pay the business portion separately and then make another payment from a personal checking account for the difference.

Don’t forget receipts

The IRS requires that receipts for all business deductions be kept for a minimum of 7 years. Unfortunately, most small businesses don’t save receipts and if they do, they are not organized in way that would help in an audit. Ideally, each expense would have a receipt attached to it in QuickBooks so that it can easily be found later. My Bookkeeping Client Portal is not only a great way to achieve this, but it can help in the process of separating business from personal expenses, too.

Pay Bills for Free in QuickBooks

There is now a newer, upgraded version of the bill payment capability in QuickBooks Online. Previously, there was a scaled-down version of Bill.com’s bill payment service, but it incurred a surcharge.

The new offering, powered by Melio, enables small businesses to pay bills directly within QuickBooks. The service is free if paying with a bank transfer or debit card. There is a fee, however, if you use a credit card, currently 2.9%.

This means that businesses no longer have to use checks with their bank’s routing and account number on them, which can be dangerous and subject to fraud. However, an actual check can still be issued with this service if a bank transfer (ACH) is not preferred or available, such as to an individual without a bank account.