Travelling Internationally: Options for Calls, Texts, Internet, Working Remotely, and Paying in Foreign Currency

Wow, it’s been almost a decade since I wrote these posts and a lot has changed!

Travel International Data: Tep Wireless vs. T-Mobile Unlimited Data vs. Verizon Global vs. Telestial

Should I Use My Credit Card Overseas? Credit Card vs. Amex Prepaid vs. Travelex

Now more than ever has being able to work remotely or stay connected while travelling been so important. It has to be seamless. Needing additional devices for data or having to rely on Wi-Fi sources for Internet access is impractical and unreliable.

Because I use so many Google services for my business and personal use, it seemed logical to switch to a Google device such as the Pixel smartphone. This has made upgrading to newer phones so simple and headache-free. But also paired with Google Fi, a no contract phone plan, it has made travelling and working abroad so much easier. Included in my plan, I am able to use the data in over 200 destinations for only $10/GB. This is capped at 6GB, after which data is free. Texts are already unlimited and not restricted when travelling outside the US. If I need to make any calls, I can easily hotspot my phone and use my laptop’s browser; otherwise, it is only 20¢/min for calls made directly on my phone. 5G is already pretty prevalent in Europe, Mexico, and the Caribbean so Internet bandwidth isn’t a problem. Most Android and iPhone® devices work with Fi, so it is easy to use the phone you already love.

I still use my favorite credit card for purchases abroad since there are no foreign transaction fees and it has chip-and-pin technology, needed when using self-checkout in grocery stores, for example. Even though I hardly use cash in the U.S., when travelling there are instances where I need to have foreign currency available. This could be for small purchases from local street vendors or farmers markets. Or it is just piece of mind knowing that I can go to practically any ATM to withdraw cash in any currency. With the Wise account/card, I can make 2 withdrawals of up to 100 USD each month for free. The only fee would be what the ATM charges, if any, and it would be at the real exchange rate, not some other inflated bank rate.

They even have an international business account. You can effortlessly pay international invoices, vendors, and employees — with the real exchange rate, in 80 countries. And it is 6x cheaper than old-school banks, and 19x cheaper than PayPal. This is a win-win for companies in the US that need to pay workers in foreign countries. The transactions can easily be added to QuickBooks by turning on multi-currency and linking the account in Banking.

Business Meals and Entertainment Deductions

Because of changes over the years, it can be quite confusing determining what is deductible and by what percentage when it comes to meals and entertainment expenses for businesses. The Tax Cuts and Jobs Act (TCJA) enacted by Congress in 2018 made several significant changes to the deductions for meals, entertainment, and employee fringe benefits, including making business entertainment expenses entirely nondeductible. The Consolidated Appropriations Act (CAA) enacted in 2021, in an effort to support the restaurant industry impacted by the COVID-19 pandemic, allows businesses to deduct 100% for the costs of some meals provided by restaurants for the 2021 and 2022 calendar years.

After combing through many websites from CPAs, tax attorneys, and the IRS, I have attempted to put together this spreadsheet to make it easier to understand the rules.

In QuickBooks, I recommend creating at least three accounts in the Chart of Accounts: Meals (100%), Meals (50%), and Meals & Entertainment (non-deductible). When adding expenses, I also recommend always having a vendor (Restaurants instead of adding the name of every restaurant to the vendor list) and putting the name of the restaurant in the memo instead along with a description of the type of expense (what it was for). I use my Bookkeeping Client Portal, for capturing restaurant and other receipts and for pushing these expenses with their attachments into QuickBooks.

What Are Projects and When to Use Them in QuickBooks Online

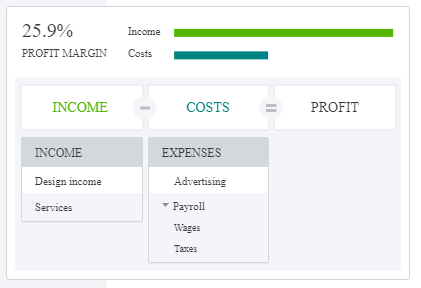

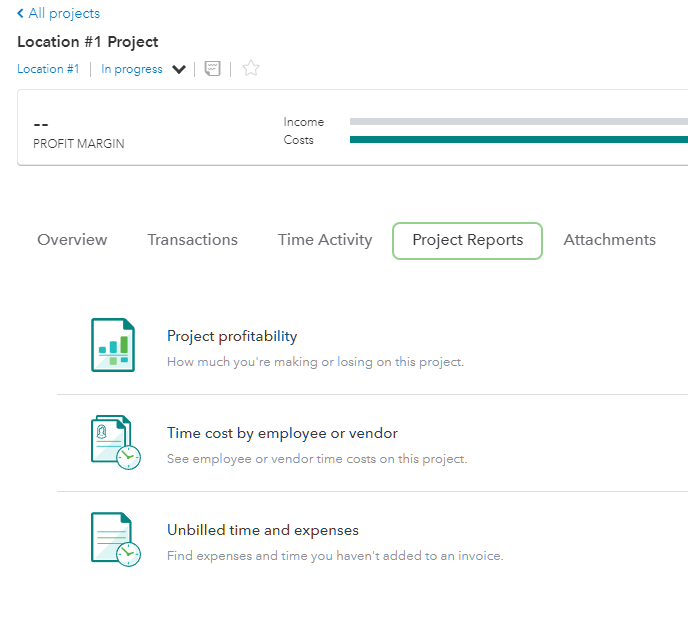

Projects is a feature only available in QuickBooks Online Plus, Advanced, and Accountant versions and it is used to track project or job profitability, traditionally referred to as job costing in QuickBooks Desktop.

By default, projects is turned on in QuickBooks Online Plus and Advanced and can be turned off by going to Settings ⚙ | Company Settings | Advanced | Projects and clicking on Edit ✎. Once turned on in QuickBooks Online Accountant, it cannot be turned off.

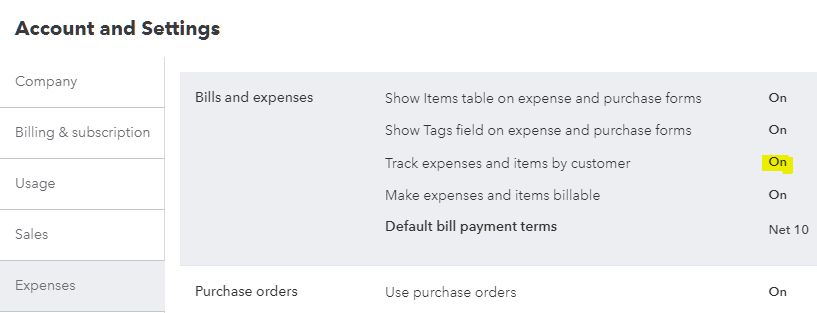

Before QuickBooks Online became as popular as it is today, QuickBooks ProAdvisors, CPAs, and other accounting professionals would tell their clients not to use QuickBooks Online because it could not do job costing. This was not entirely true and probably said because of an aversion to change, loyalty to only desktop products (and/or hatred of anything web-based), or just lack of certification, use, or knowledge of the online version. Whatever the reason, QuickBooks Online always had the ability to create sub-customers, or what are known in QuickBooks Desktop as jobs. In the Plus and higher versions, you can turn on Track expenses and items by customer by going to Settings ⚙ | Company Settings | Expenses and clicking on Edit ✎ and toggling on (green).

Another reason why QuickBooks Online was not recommended for job costing could be its lack of included job related reports, as found in the the Contractor edition of QuickBooks Premier or Enterprise. However, the inclusion of the Profit and Loss by Customer in QuickBooks Online is sufficient in viewing any job’s or sub-customer’s profitability as related to job income and expenses (checks, bills, expenses, or journal entries with a Customer associated with line item amounts). If this alone is needed, then Projects does not need to be turned on.

So Why Turn On Projects?

Projects is a feature that was added later on, probably due to the misconception or lack of knowledge of using sub-customers and the report as mentioned previously. There is no differentiation between jobs or projects and sub-customers, as existing sub-customers are just converted to projects. Creating a new project just creates a new sub-customer. I have also previously advised against turning on projects because 3rd party apps are not able to use this feature (not accessible via the QuickBooks Online API). While the projects dashboard looks great and does a good job of summarizing project profitability with profit margin, more complex businesses such as construction companies with a lot of employees or service-based contractors use 3rd party apps for estimating, running payroll, and invoicing.

I would only recommend turning on projects if a business needs to track labor costs, especially if already using QuickBooks Online Payroll. Since the acquisition of TSheets by Intuit, now called QuickBooks Time, projects are integrated in this time tracking feature that flows into running payroll. If you don't use QuickBooks Online Payroll, you can still set up your chart of accounts to track your payroll expenses. You'll just have to enter the expenses manually each time you run payroll. I am not a big fan of doing anything manual and this is the only instance were I would not recommend using an outside payroll service.

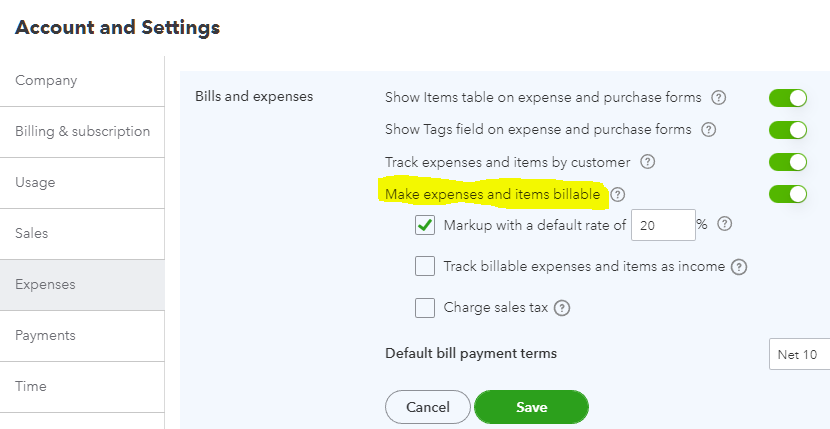

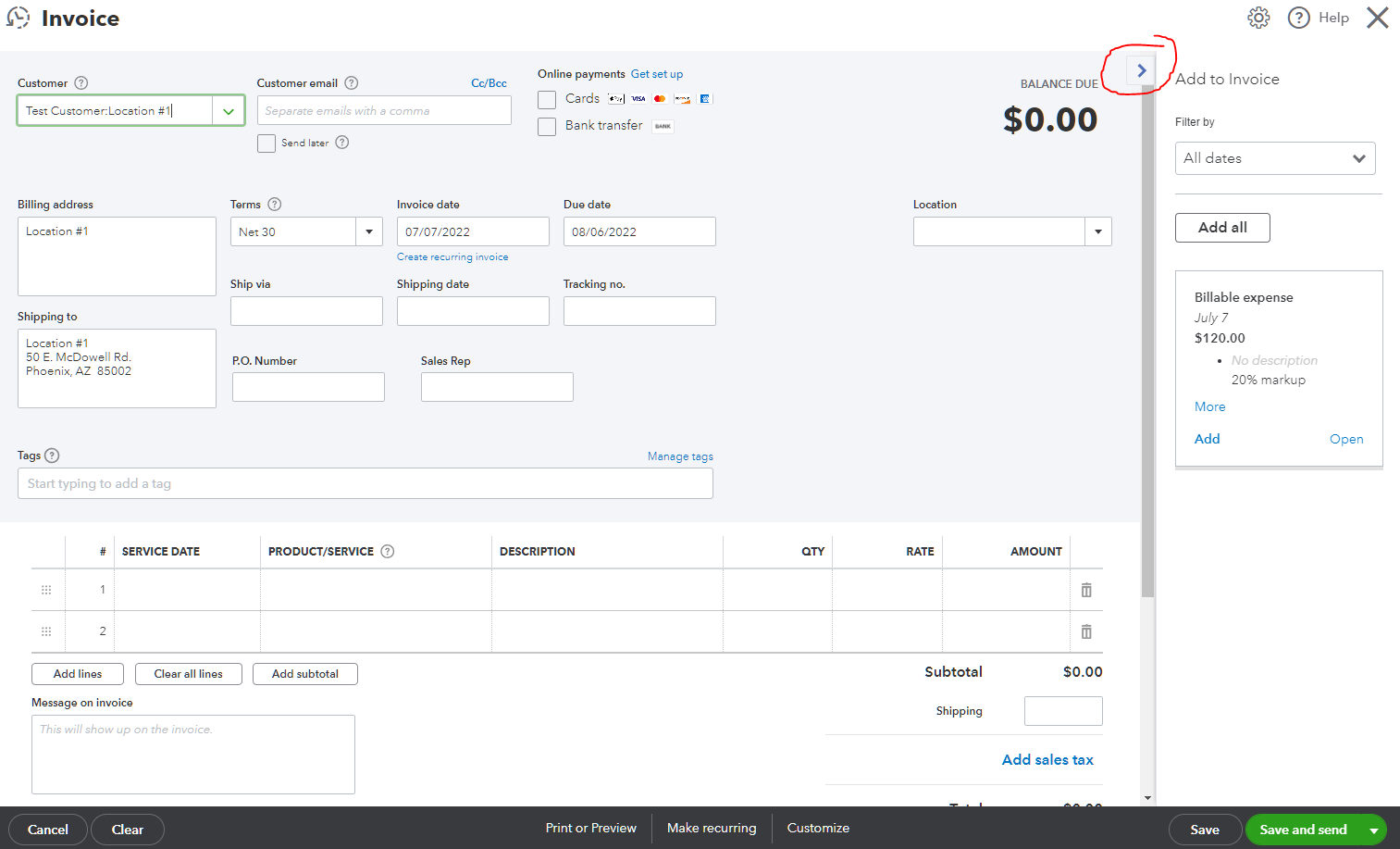

Another reason to turn on projects is if a business needs to automatically mark up expenses when invoicing customers. This is turned on by going to Settings ⚙ | Company Settings | Expenses and clicking on Edit ✎ and toggling on (green) for Make expenses and items billable. For service industries that have to bill all costs to their customers, by turning on this feature, QuickBooks Online will always show unbilled costs in what I call the drawer on the right when creating an invoice. This prevents any cost from being missed that is supposed to be marked up and billed to a customer.

And the tabs within each project help with seeing all project related info including billable expenses in one place without having to customize more general reports.