How to Make a Negative Deposit In QuickBooks: UPDATED

Updated May 4th, 2023: You can now record a negative deposit transaction in QuickBooks Online.

You can’t. From an accounting standpoint, there is no such thing, as a deposit is money added to the checking account. However, refunds to customers, specifically credit card refunds that are batched with charges that are less than the total amount refunded, is pretty common with some credit card processors and Stripe.

Solution

Create a new bank account in the Chart of Accounts called Clearing Account.

2. Create a new Bank Deposit.

3. Select Clearing Account for the Account.

4. Select refund (negative amount) and any other payments included in the deposit.

5. Under Add funds to this deposit, select the Checking Account under Account and enter the total amount of the deposit as a positive number. The net deposit amount should be $0.00.

6. In Banking, the negative deposit is now a Match.

Year End Tasks You Should Be Doing Now in QuickBooks

As 2020 comes to a close, thankfully, now is the time to get a head start on organizing your books and closing out the year in QuickBooks.

Apply for PPP Loan Forgiveness

While it is still fuzzy as to the deductibility of expenses used in forgiveness of a PPP loan, borrowers who took PPP loans of $50,000 or less to pay for qualified expenses, such as payroll, mortgage interest payments, rent, and other eligible costs, can apply for total loan forgiveness now. The application is simpler and can be completed quickly.

Reconcile All Accounts in QuickBooks

Frequently put off, it is important that all accounts, not just bank and credit card accounts, are reconciled through at least the 3rd quarter. This includes loan and other long term liability accounts. Void any uncleared transactions. Contact vendors of any uncleared checks. Verify sales tax and payroll liability account balances are correct, as applicable. Reconciliations confirm that what is in QuickBooks matches what has happened dollar for dollar in real life.

Check Financial Statements

Create a Profit and Loss statement on an accrual basis. Even if you file on a cash basis, this will ensure that you aren’t missing any transactions that may have been miscategorized or duplicated. Also create a Balance Sheet and check for accounts that don’t have normal balances, such as negative expenses, liabilities, or assets. If you use subaccounts, make sure that there are no balances in the parent account. In QuickBooks desktop, this will appear as Account - Other.

Run Other Reports

Create a Custom Transaction Detail Report (desktop) or Transaction List by Date (QBO) and group by Name (Payee) and filter for expense type transactions. If all expenses have a payee or vendor name (recommended), then verify the split or category is consistent for each name, as applicable. In QuickBooks Online, navigate to Expenses and make sure all transactions have attachments (recommended). I use Receipt Bank to streamline this process.

Write Off Bad Debt

Run an A/R Aging Summary report. Attempt to collect on any balances over 90 days past due. If uncollectible, create credit memos to a Bad Debt item posting to a bad debt expense account and apply to overdue invoices.

Evaluate Business Performance and Processes

Run the Business or Company Snapshot. Compare previous year to current year income and expenses. Determine if switching to a better payroll service would benefit the company. Investigate apps to eliminate duplicate entry or to improve efficiency. Hire a ProAdvisor if you can’t do all this yourself and need help.

Is QuickBooks Desktop Going Away?

When QuickBooks Online (QBO) was revamped and marketed like crazy in 2014, I predicted that QuickBooks Desktop (QBD) would be discontinued starting in 2018, with the 3 year sunset window culminating in a complete phase out in 2021. Well, that never happened, at least not any indication of Intuit pulling the plug on QBD.

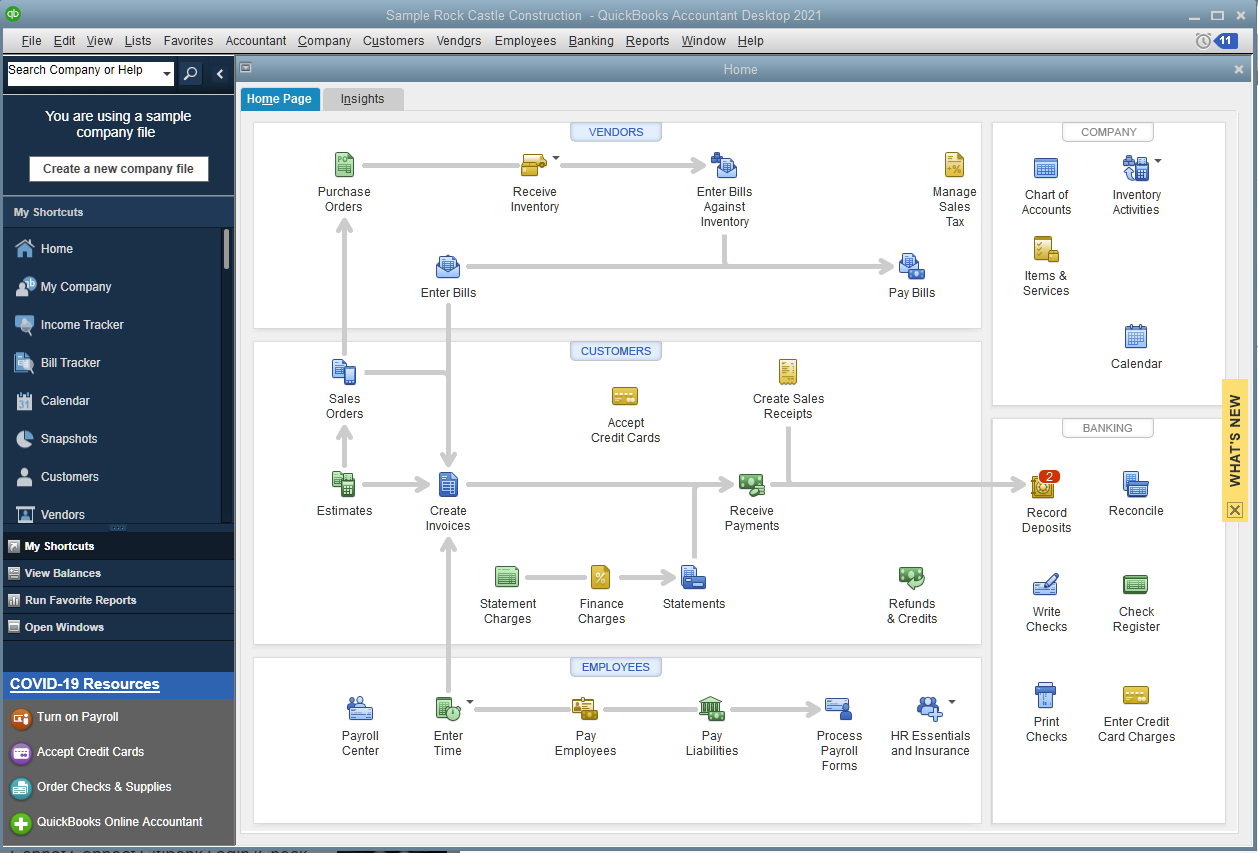

QuickBooks Desktop 2021 Released

Instead, Intuit continues to improve QBD, so much so that it is starting to look like QBO, especially with the latest release of QuickBooks Desktop 2021. I have always touted the superiority of the Banking page in QBO for its automation of downloading transactions from bank and credit card accounts and auto-categorization of transactions. Even the Rules were more sophisticated with the ability to create multiple conditions. But now you can turn on Advanced Mode for Bank Feeds in QuickBooks Desktop 2021, which essentially embeds a web page that looks very similar to the Banking page in QBO, with tiles for the accounts and wider rows with larger fonts that make it easier to view downloaded transaction detail. It still doesn’t automatically download transactions like it does in QBO (you have to click on Update). So instead of hardcoding the page using the same Windows code that is seen with other windows in QBD, Internet Explorer is used to display the URL for the Bank Feed in Advanced Mode.

Features Restricted by Subscription

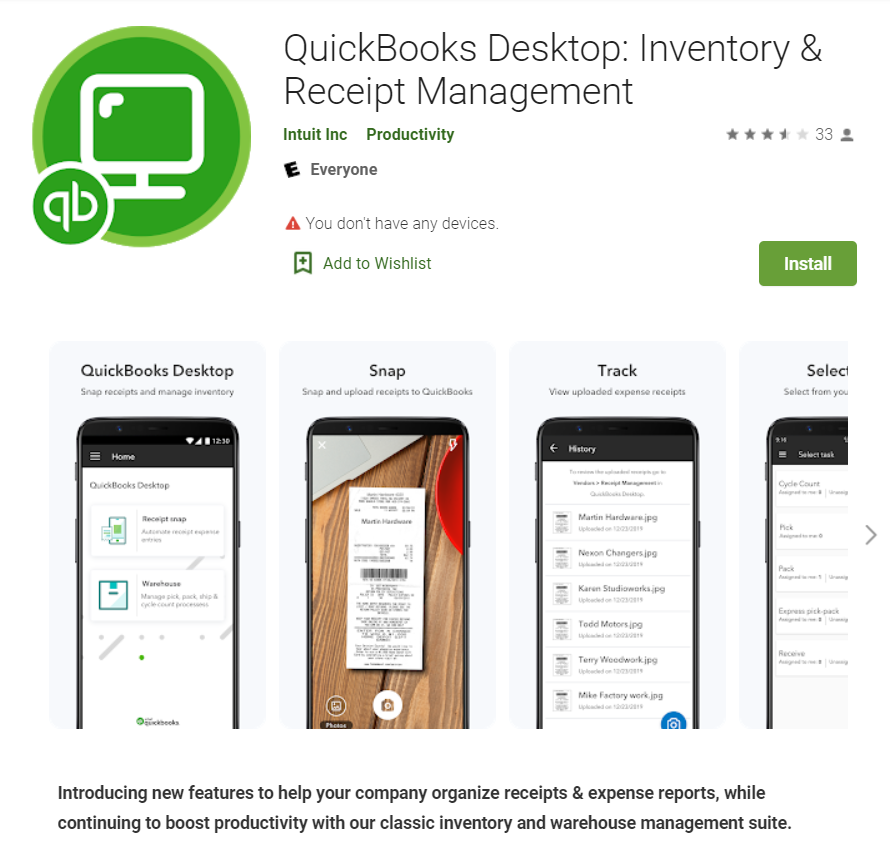

Another new feature that works off of the QBO playbook is Receipt Management; however, it is not available in QuickBooks Desktop Pro or Premier, only the Plus versions of those, which is based on a yearly subscription. Similarly, this feature is available in the subscription-based QuickBooks Enterprise. Receipt Management in QBD looks and works very similarly to the Receipts page in QBO, again using a web page within QBD. In my tests, this feature still lacks much functionality compared to Receipt Bank.

Intuit discontinued a mobile app for QBD years ago, but in its place came a new app that only can be used with the Advanced Inventory module for QuickBooks Desktop Enterprise, available only in the Diamond (highest tier) subscription, currently with a retail price of over $3,800 for one user per year. It seems odd that Receipt Management would only be available in an app that previous was only for mobile warehouse management, although somewhat lacking compared to other mobile apps.

So while desktop is not going away, it is still relevant for the subscription model of Plus and Enterprise, and I would expect more features added only to these versions. I also expect to see these features as embedded web pages in the Windows program and in the mobile apps. It seems like desktop is turning into a hybrid of both a desktop program and a series of web pages.

Personally, I prefer the look of the web pages (and QBO in general) compared to the small fonts used in QBD’s lists and centers. And I can log into QBO and start working faster than launching QBD and waiting for it to load (and being road blocked by pop ups), among many other advantages. I think it will only be a matter of time where the desktop will morph into something so similar to QuickBooks Online, that desktop will no longer be relevant, at least starting with the non-subscription versions.