Speed Up Receivables Using Intuit Payment Network

The last few years have probably taken a toll on your accounts receivable. A bad economy can result not only in slow sales, but in slow customer payments.

Make it easy for your customers to pay, and it's likely they'll pay faster. You can accomplish this simply and cost-effectively through the

Intuit Payment Network

.

If you're using QuickBooks 2010 or later and are willing to spend 50 cents per payment received to get that money in your bank account faster, consider

electronic invoicing

.

Readying QuickBooks

When you

for the Intuit Payment Network (no setup fee or monthly charges), you'll be able to include a link in your invoices that takes customers to a secure site where they can enter their bank account or credit card information to pay the invoice.

First, though, make sure that QuickBooks is set up for this service. Go to

Edit | Preferences.

Click on

Payments

, then the

Company Preferences

tab. Check the two boxes below

Enable online payment via Intuit Payment Network

and enter the email address that you want to use (only the administrator can activate these preferences).

Figure 1: Make sure that QuickBooks is set up for electronic invoicing.

Just like online banking

Once you've completed this and Intuit has notified you that your account is active, the rest is equally easy. When you create an invoice, the box in the lower left of the screen next to

Show online payment link on invoices

will be checked. Just fill out the invoice like you normally would and save it.

When you send these invoices, they'll include a short paragraph telling customers that they can remit payment online, with a link taking them to the web page:

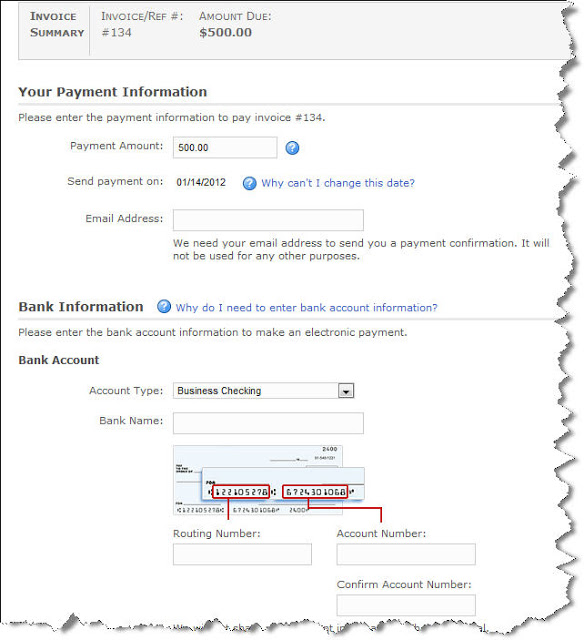

Figure 2: Customers who pay bills online will recognize this process.

Once customers transmit their payments, the funds will move into your bank account within a day or two, minus the 50-cent service charge on bank account payments or 3.25 percent of the transaction amount for credit cards. QuickBooks versions differ on the process for updating your file.

Intuit offers numerous ways to accept payments on your PC or mobile device. We can help you select the right one(s) and get your cash flow moving in a more positive direction.

QuickBooks Income Tax Reports And Filtering Options: Target The Right Output

April 15 is getting uncomfortably close.

QuickBooks, of course, can't do your taxes for you. But it helps you lay some of the groundwork. Following up on last month's column on customizing reports, we'll look at the program's tax-related reports and its powerful report-filtering options.

But first, you'll need to make sure that this output will be accurate.

Describe your company accurately

Your

tax entity

setting should have been established when you first set up QuickBooks, but verify that you've specified the correct one. Go to

Company | Company Information

. Your

Report Information

is in the lower left corner. Click the arrow next to

Income Tax For

m

Used

to see what's active.

Figure 1: Make sure that QuickBooks is set up for the correct tax entity.

QuickBooks automatically assigns some of your accounts to their matching lines on the 1040 and assorted forms and schedules; this is called

tax line mapping

. So when you create tax reports, related transactions will be grouped by these designations.

This can be a real time-saver –

as long as you've specified the correct entity.

If:

·

was selected

·

This setting is incorrect

·

You're starting a business and don't know which to choose…

…

please contact us

. If you switch entities, your existing tax line mapping

will disappear and will have to be reassigned.

Dedicated tax reports

Many of QuickBooks' general financial reports provide tax-related information. But there are some that specifically relate to the numbers that will go on your return. Go to

Reports | Accounting & Taxes | Income Tax Preparation

. Here's an excerpt of what you'll see:

Figure 2: QuickBooks automatically assigns many accounts to the appropriate tax form lines, based on your specified tax entity.

Here, QuickBooks shows you which tax lines have been pre-assigned to your accounts. You

can

specify a tax form line for unassigned accounts, but

this is something you should not attempt on your own.

This report, though, will give you an idea of how useful your report output will be and where you'll need our assistance.

Other reports provide tax-related data. You can access them by going again to

Reports | Accountant & Taxes

and clicking:

·

Income Tax Summary.

This displays totals for each tax line that's relevant to your particular tax entity. Double-click on any number, and the

Tax Line By Account

report appears, detailing every transaction related to every tax-related account (you could add a column for

Tax Line

in

Display

options and make this quite a useful report).

·

Income Tax Detail.

This lists all individual transactions by tax form/schedule line assignment.

Paring it down

Some tax reports can be very lengthy; you may want to filter them to look at various "slices."

Click

Customize Report | Filters

:

Figure 3: This window displays a powerful set of filtering options.

The options listed under

Choose Filter

are available on other reports; they help you set up incredibly complex searches using multiple filters.

Let's say you want a report that displays your installation labor costs on new residential construction from the last year (you could also throw other variables in). You'd simply choose the filters from the left pane and then select related options in the next pane (usually a list). You'd want to also click on the

Display

tab to make sure that the appropriate columns appear.

Figure 4: You can apply multiple filters to your reports.

QuickBooks reports can shave time off of tax preparation, and filtered views help you scrutinize your data in quite creative – and very useful – ways. The program's boilerplate reports have their place in simple examinations of your financial status, but filters are potent tools. They can facilitate the kind of deep analysis that helps you make critical business decisions.

If you have questions on this or any other QuickBooks feature, call or email us. We’re your partner and we’re here to make your business better.

Go Get Your Black Friday Deals Now!

#000000 Friday Deals are Here!

These incredible deals will last

only on Black Friday

or through December 1

st

.

[1]

Choose from any of these insane deals!

1

Unlimited

Go Geek Geek!

Technical Support,

when bundled with

Monthly Unlimited Payroll

for only $299 per month.

[2]

Unlimited Web Hosting

, shared hosting with

unlimited

domains & e-mail accounts for as low as $3.97/month (pre-paid), available for

1 day only!

I use Hostgator to host all my domains and easily manage my web pages and e-mail accounts. Take advantage of this offer and get 20% off my technical support to get you up and running.

[3]

Unlimited Phone Service

for 2 years for only $149 with

VOIPo

, available for

1 day only!

Enter my phone number 6023249322 in the ‘Referral’ box and I will help you set it up for Free!

[4]

Purchase Fishbowl Inventory

and get

Five (5)

hours of

Go Get Geek!

Technical Support to get you started for

Free!

[5]

Method CRM Pro for QuickBooks Desktop

– $40.00 per user per month and get your first screen set up for

Free!

[6]

Take your QuickBooks into the cloud and customize it to match your business processes. Your first month of subscription is Free!

[1]

Hostgator & VOIPo offers only valid on Black Friday. Fishbowl Inventory offer valid through November 28

th

. Method Integration and Unlimited Payroll deals valid through December 1

st

.

[2]

Intuit Online Payroll account managed by Go Get Geek! for up to 10 employees and 2 states. Unlimited technical support for QuickBooks and QuickBooks-related issues only provided by phone, remote online session, or in-person, subject to availability.

[3]

20% off my current hourly rate for limited technical support for Hostgator setup, including domain and e-mail account set up, web page design, and file management if purchased via image link.

[4]

Free Go Get Geek! technical support only when referral phone number used.

[5]

Technical support offer only valid when referred by Go Get Geek! Contact us so that we can get you in touch with our sales rep at Fishbowl Inventory.

[6]

Method Integration pricing starts December 1

st

. Free screen includes up to 10 fields, 10 basic objects, 1 grid or calendar object, and 10 actions and is valid with first month of paid subscription to Go Get Geek!.