How I Moved My Business Into The Cloud

I consider myself an early adopter of new technology. As primarily a QuickBooks consultant, when I learned that there was a newer (and hopefully better) updated version of QuickBooks Online (QBO) in April of last year called "Harmony", I saw the writing on the wall. Having worked at Intuit, I knew that they were very strategic when it comes to putting most of their resources into specific products. For years, technologists have been talking about the "cloud" as if it was some place in the netherworld and it seemed like everyone was intrigued but skeptical. I can remember only a year prior when Quicken 2013 added a mobile app where you can sync your data into their cloud and I was reluctant to "share" all those years of my financial history. And let's not forget that QuickBooks Online has been around for many years, but was always considered the worst choice and never recommended by consultants, having even less features than QuickBooks for Mac.

Up until this point, there was a lot of recent disruption in the computing world. Windows 8 came out and it was a disaster. And I hated the look and feel of Office 2013/365. As someone who was dedicated to the Microsoft platform over Apple, this was a speed bump for me as an early adopter. Since the smartphone was becoming more prevalent and I worked mostly remotely with my clients, the need to access my data anywhere became the higher priority. Like many millions of users, I loved Microsoft Outlook and had been using it for years. However, I struggled with Google calendar syncs and the major pain of moving to a new computer. Then,

Google was no longer a search company with the Android and Chrome operating systems. I had already been using Gmail for my personal emails and loved the fact that it came with me on my smartphone, along with other Google services. So why couldn't I take my work with me?

Most of my stuff was already in the cloud, scattered among various services like Dropbox, SmartVault, and Picasa but tethered to data in my desktop.

was a godsend as it took my QuickBooks Enterprise Solutions into an even more robust web-based database management system. Being fully customizable, I was able to create and track different aspects and processes of my business, all linked to data that was already in my QuickBooks. But I was still coming back to the office to do the major email and accounting work. I had known about Method CRM's Gmail Gadget, released in the prior year, but Outlook and the fact that I had to move my work domain to

, was holding me back, but only temporarily.

I like the idea of signing into a service anywhere and on any device and there is my data. I am very technical, but I was tired of the time-consuming tasks of installation, migration, backing up and recovering data. I didn't have to do this with my Chromebook: a clean, simple OS with apps and extensions that you can install and remove in seconds.

But I wanted all of my services available and able to talk to each other. And then it dawned on me: Google Apps for Work + Method CRM with Gmail Gadget and Google Calendar Sync + QuickBooks Online.

It was hard for me to dump Outlook to move to what I criticized Microsoft for doing with simpler graphical user interfaces, but once I started using Gmail for work, I never looked back. I loved the Google ecosystem of emails, calendars, shared documents, storage and more all tied together under one single login and available on my desktop, smartphone, and laptop. Adding any new device was going to be a no brainer.

And now I was able to create new leads, track activities with existing clients, and see transactions and balances from QuickBooks all within my email. Now, I just needed to test out QuickBooks Online, which I did while still working in QuickBooks for Desktop in tandem for several months. I didn't miss the latter's issues with QuickBooks Payments sometimes not coming in, Intuit Online Payroll's One-Click Export for Windows not working without reverting back to an older version of Internet Explorer, and other headaches. QuickBooks Online was truly freedom in the cloud.

I dumped the desktop in October 2014. While most of my colleagues and users would complain about its lack of features compared to the desktop versions, I had Method CRM to fill in the gaps, although I learned sadly shortly thereafter that their version for QBO didn't have a full sync and currently still doesn't. There are QuickBooks vendors and bills, but no checks, bill payments, expenses, etc. on the costs side of things. But this was not major for my business. Besides, Intuit was updating and improving QBO practically monthly, so new features were becoming available on a regular basis. No more waiting a year for a new version of QuickBooks. And now with the recently

, I no longer have to worry about QBO going down, which it has in the past, as I can now access and work in data offline.

The last holdouts on my desktop are Microsoft Word and Excel, which I use sometimes out of habit for manipulating photos and text for quick image snipping in the former and quick exports with the latter. I no longer have a physical phone on my office desk, which has been replaced by a Bria softphone on my computer. And sadly, my dear friend and longtime favorite, Quicken, is being dumped by Intuit, which was what that company was founded on. What's next? Probably the actual PC, monitor and keyboard...but I'll be ready!

How To Record Use Tax in QuickBooks Online for Sales Tax Reporting

Who Pays Use Tax? Well, it depends on the state, but according to Arizona, where I am located:

1. Any person who uses, stores or consumes any tangible personal property upon which tax has not been collected by a retailer shall pay use tax.

2. An out-of-state retailer or utility business making sales of tangible personal property to Arizona purchasers must register with the department for the collection of the use tax.

3. An Arizona purchaser is liable for use tax on goods purchased from an out-of-state vendor that did not collect the use tax. For individual income taxpayers, please see Pub 610A, Arizona Use Tax for Individual Income Taxpayers.

4. Arizona purchasers are liable for use tax if they purchase goods using a resale certificate, and the goods are subsequently used, stored or consumed in Arizona contrary to the purpose stated on the certificate.

5. The use tax also applies to purchases on which another state's sales tax or other excise tax was imposed if the rate of that tax is less than the Arizona use tax rate.

A lot of my clients have inventory and sometimes they will use a product to replace a faulty product or one under warranty for a customer. And since they don't pay sales tax on the purchase of the product, when they consume it they have to pay the state for the sales tax on the cost of the product.

This is how you set up, record, and pay Use Tax in QuickBooks Online.

1. In QuickBooks, click on Sales Tax in the Navigation bar on the left.

2. Click on Add/edit tax rates and agencies and New button.

3. Name it Use Tax and enter your single or combined tax rate information based on your company's local sales tax.

4. Go to the Gear icon, Lists, Products and Services.

5. Click on New to create a new product called Use Tax Income Offset using the same income account used when selling products and uncheck Is Taxable box.

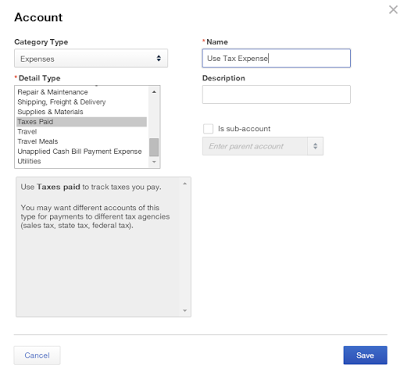

6. Create a new expense account, Use Tax Expense in your Chart of Accounts if you don't already have one.

8. Back in the Products and Services list, create a new product called Use Tax Expense that is not taxable using the Use Tax Expense account.

9. Use a sales transaction (sales receipt or invoice) to record the products used and either use a "house" customer account or the actual customer that it is used for and change the tax rate to the Use Tax rate.

10. Change the rate of the product from the sales price to the cost.

11. Add the Use Tax Income Offset item and put the negative of the cost above.

12. Add the Use Tax Expense item and put the negative of the tax amount below.

13.

This will zero out the Sales Receipt. Save and Close.

14. The Sales Tax Center and Sales Tax Liability report will now show the Use Tax amount due and will be included when you Record Tax Payment.

15. The Profit & Loss statement will now reflect the purchase cost of the product and the use tax expense related to using it and the income account isn't affected.

How to Record Prepaid Inventory in QuickBooks Online

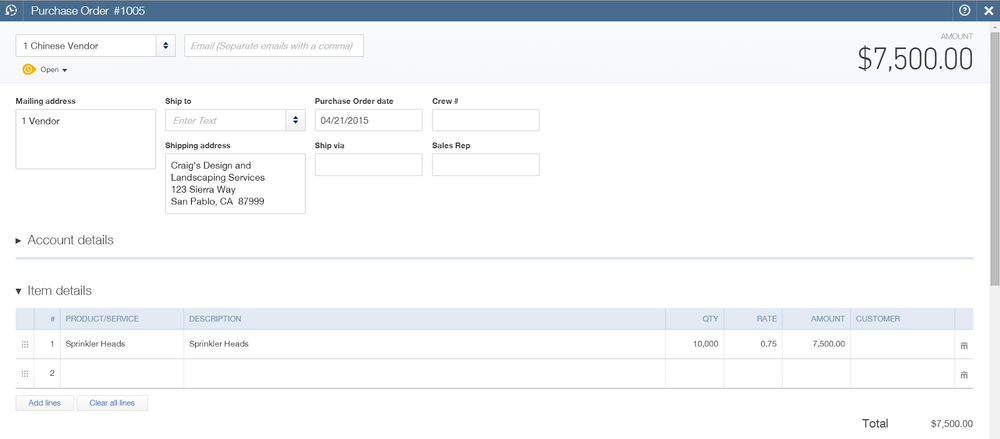

A lot of manufactures, wholesalers, and distributors buy their products or materials from China. Along with a purchase order, a pre-payment (or multiple payments), usually in the form of a wire transfer, is generally required before the items are shipped and received.

Here is the process for recording prepaid inventory in QuickBooks Online:

Enter a Purchase Order as you normally would for inventory items.

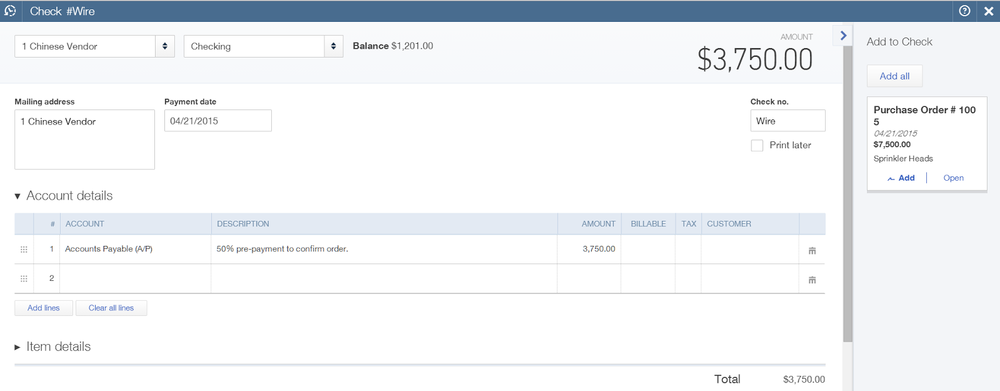

Record the pre-payment as a Check or Expense using Accounts Payable for the expense account.

The pre-payment will now show as a credit for the open balance of the vendor.

When the shipment is received, create a bill from the purchase order.

The remaining balance will now show as the open balance for the vendor.

Make a payment (bill payment).

The bill and the prior pre-payment(s) are checked automatically and the difference, if any, is recorded as a check (or credit card payment).