Is QuickBooks Desktop Going Away?

When QuickBooks Online (QBO) was revamped and marketed like crazy in 2014, I predicted that QuickBooks Desktop (QBD) would be discontinued starting in 2018, with the 3 year sunset window culminating in a complete phase out in 2021. Well, that never happened, at least not any indication of Intuit pulling the plug on QBD.

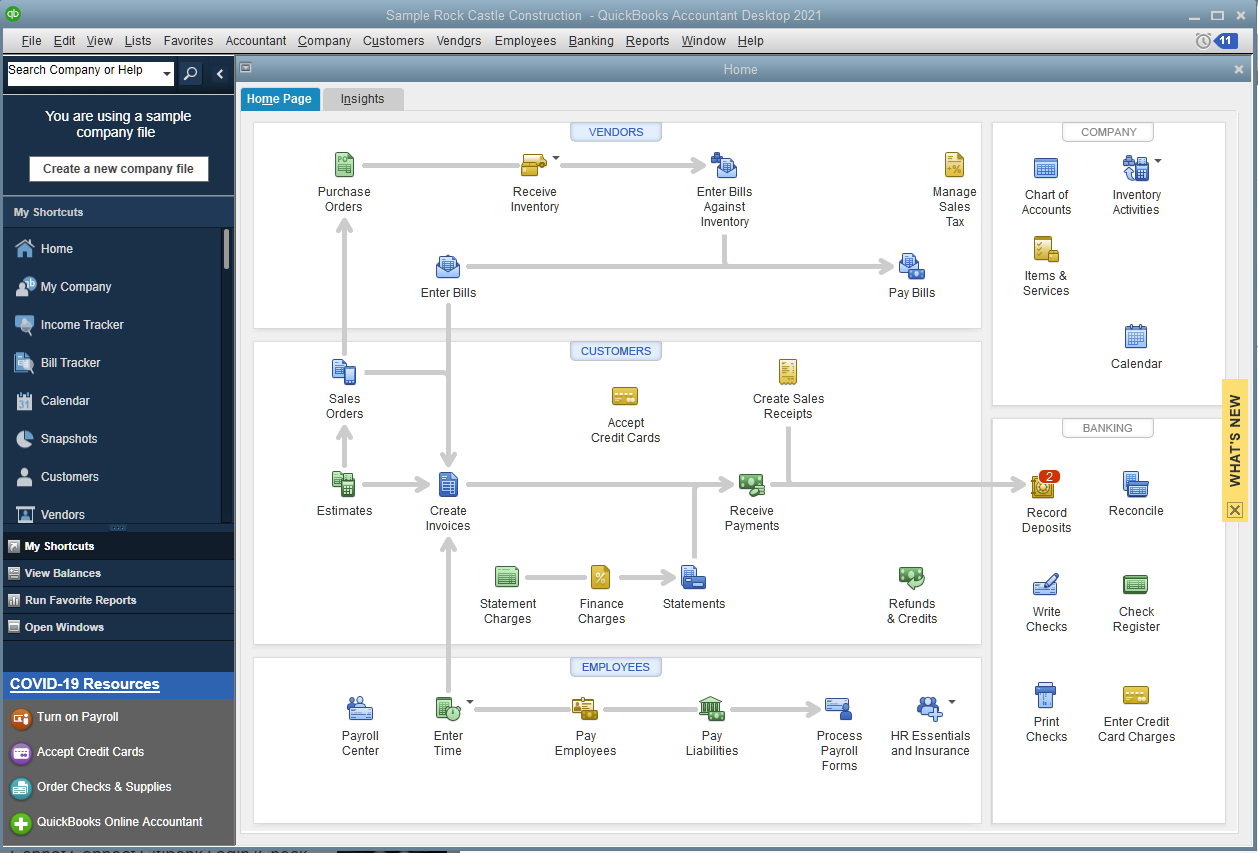

QuickBooks Desktop 2021 Released

Instead, Intuit continues to improve QBD, so much so that it is starting to look like QBO, especially with the latest release of QuickBooks Desktop 2021. I have always touted the superiority of the Banking page in QBO for its automation of downloading transactions from bank and credit card accounts and auto-categorization of transactions. Even the Rules were more sophisticated with the ability to create multiple conditions. But now you can turn on Advanced Mode for Bank Feeds in QuickBooks Desktop 2021, which essentially embeds a web page that looks very similar to the Banking page in QBO, with tiles for the accounts and wider rows with larger fonts that make it easier to view downloaded transaction detail. It still doesn’t automatically download transactions like it does in QBO (you have to click on Update). So instead of hardcoding the page using the same Windows code that is seen with other windows in QBD, Internet Explorer is used to display the URL for the Bank Feed in Advanced Mode.

Features Restricted by Subscription

Another new feature that works off of the QBO playbook is Receipt Management; however, it is not available in QuickBooks Desktop Pro or Premier, only the Plus versions of those, which is based on a yearly subscription. Similarly, this feature is available in the subscription-based QuickBooks Enterprise. Receipt Management in QBD looks and works very similarly to the Receipts page in QBO, again using a web page within QBD. In my tests, this feature still lacks much functionality compared to Receipt Bank.

Intuit discontinued a mobile app for QBD years ago, but in its place came a new app that only can be used with the Advanced Inventory module for QuickBooks Desktop Enterprise, available only in the Diamond (highest tier) subscription, currently with a retail price of over $3,800 for one user per year. It seems odd that Receipt Management would only be available in an app that previous was only for mobile warehouse management, although somewhat lacking compared to other mobile apps.

So while desktop is not going away, it is still relevant for the subscription model of Plus and Enterprise, and I would expect more features added only to these versions. I also expect to see these features as embedded web pages in the Windows program and in the mobile apps. It seems like desktop is turning into a hybrid of both a desktop program and a series of web pages.

Personally, I prefer the look of the web pages (and QBO in general) compared to the small fonts used in QBD’s lists and centers. And I can log into QBO and start working faster than launching QBD and waiting for it to load (and being road blocked by pop ups), among many other advantages. I think it will only be a matter of time where the desktop will morph into something so similar to QuickBooks Online, that desktop will no longer be relevant, at least starting with the non-subscription versions.

Trick to Separate Business from Personal Expenses in QuickBooks

Accountants always say not to mix personal and business expenses. Ideally, small businesses should have a business credit card in addition to a business checking account. However, in this day and age where points, airline miles, and cash back incentives reign supreme, it is hard to resist using certain cards for different types of spend. For example, there may be a card where a minimum total spend for the year qualifies for elite status on an airline and using that card for both personal and business expenses helps reach that milestone faster.

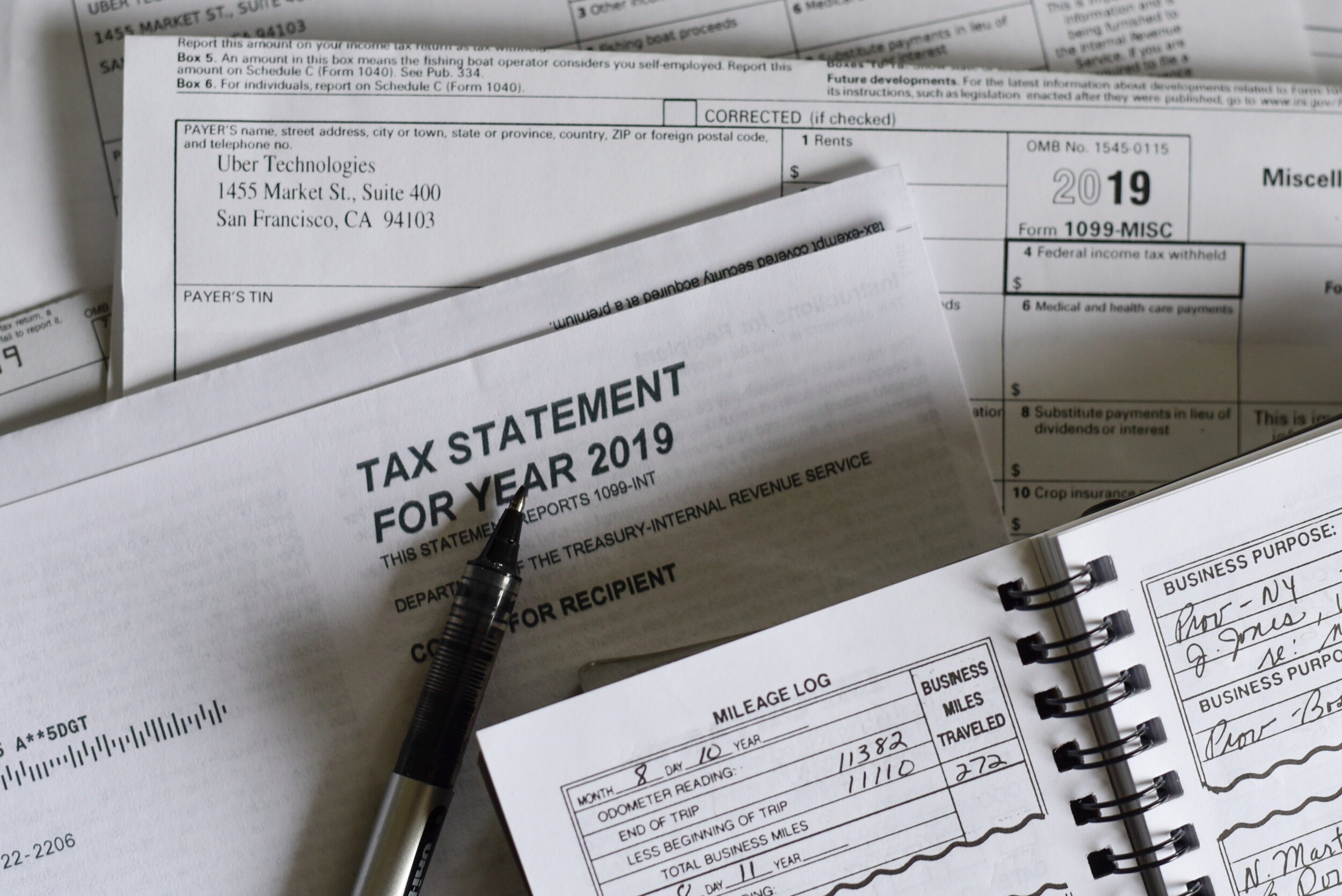

Of course, small business owners want to be careful not to include any personal expenses in business deductions. And misclassifying these transactions in QuickBooks, other than an Owner’s Draw or Loan to Shareholder, can have negative tax implications.

Here’s the trick

Add the credit card account to QuickBooks in Banking, or Bank Feed in desktop.

Exclude all personal transactions that are downloaded.

Pay off the “In QuickBooks” balance in full periodically by making a payment from the business checking account to the credit card account.

Reconcile the account, after the payment posts, to a zero ending balance.

Even if you pay off the credit card in full each month, it is important to pay the business portion separately and then make another payment from a personal checking account for the difference.

Don’t forget receipts

The IRS requires that receipts for all business deductions be kept for a minimum of 7 years. Unfortunately, most small businesses don’t save receipts and if they do, they are not organized in way that would help in an audit. Ideally, each expense would have a receipt attached to it in QuickBooks so that it can easily be found later. My Bookkeeping Client Portal is not only a great way to achieve this, but it can help in the process of separating business from personal expenses, too.

Pay Bills for Free in QuickBooks

There is now a newer, upgraded version of the bill payment capability in QuickBooks Online. Previously, there was a scaled-down version of Bill.com’s bill payment service, but it incurred a surcharge.

The new offering, powered by Melio, enables small businesses to pay bills directly within QuickBooks. The service is free if paying with a bank transfer or debit card. There is a fee, however, if you use a credit card, currently 2.9%.

This means that businesses no longer have to use checks with their bank’s routing and account number on them, which can be dangerous and subject to fraud. However, an actual check can still be issued with this service if a bank transfer (ACH) is not preferred or available, such as to an individual without a bank account.