Fun Stuff You Can Do in QuickBooks Online

Emojis

Since QuickBooks Online is web-based, what you can do in a web browser will sometimes also work in QBO. Emojis are pretty common in text messages and emails. So are animated gifs. Accounting can be boring stuff, so to brighten up your books and have some fun, use emojis!

When creating expenses, you can either right-click or hit the Windows key and Period (for PC users) in any text field and select an emoji. This works great in the DESCRIPTION field.

They even show up in reports!

So, say good riddance to 2020 💩 and good day to a funner and brighter 2021 🥂!

Year End Tasks You Should Be Doing Now in QuickBooks

As 2020 comes to a close, thankfully, now is the time to get a head start on organizing your books and closing out the year in QuickBooks.

Apply for PPP Loan Forgiveness

While it is still fuzzy as to the deductibility of expenses used in forgiveness of a PPP loan, borrowers who took PPP loans of $50,000 or less to pay for qualified expenses, such as payroll, mortgage interest payments, rent, and other eligible costs, can apply for total loan forgiveness now. The application is simpler and can be completed quickly.

Reconcile All Accounts in QuickBooks

Frequently put off, it is important that all accounts, not just bank and credit card accounts, are reconciled through at least the 3rd quarter. This includes loan and other long term liability accounts. Void any uncleared transactions. Contact vendors of any uncleared checks. Verify sales tax and payroll liability account balances are correct, as applicable. Reconciliations confirm that what is in QuickBooks matches what has happened dollar for dollar in real life.

Check Financial Statements

Create a Profit and Loss statement on an accrual basis. Even if you file on a cash basis, this will ensure that you aren’t missing any transactions that may have been miscategorized or duplicated. Also create a Balance Sheet and check for accounts that don’t have normal balances, such as negative expenses, liabilities, or assets. If you use subaccounts, make sure that there are no balances in the parent account. In QuickBooks desktop, this will appear as Account - Other.

Run Other Reports

Create a Custom Transaction Detail Report (desktop) or Transaction List by Date (QBO) and group by Name (Payee) and filter for expense type transactions. If all expenses have a payee or vendor name (recommended), then verify the split or category is consistent for each name, as applicable. In QuickBooks Online, navigate to Expenses and make sure all transactions have attachments (recommended). I use Receipt Bank to streamline this process.

Write Off Bad Debt

Run an A/R Aging Summary report. Attempt to collect on any balances over 90 days past due. If uncollectible, create credit memos to a Bad Debt item posting to a bad debt expense account and apply to overdue invoices.

Evaluate Business Performance and Processes

Run the Business or Company Snapshot. Compare previous year to current year income and expenses. Determine if switching to a better payroll service would benefit the company. Investigate apps to eliminate duplicate entry or to improve efficiency. Hire a ProAdvisor if you can’t do all this yourself and need help.

Beware: New Banking Page in QuickBooks Online Confuses

New Banking Page

What has changed

A couple of my clients have pointed out to me recent changes in their QuickBooks Online accounts that is causing confusion and dissatisfaction. Apparently, Intuit changed the look of their Banking page. Unfortunately, as a QuickBooks ProAdvisor, I was not made aware of this update and I participate in the monthly In The Know webinars on QuickBooks Online Updates.

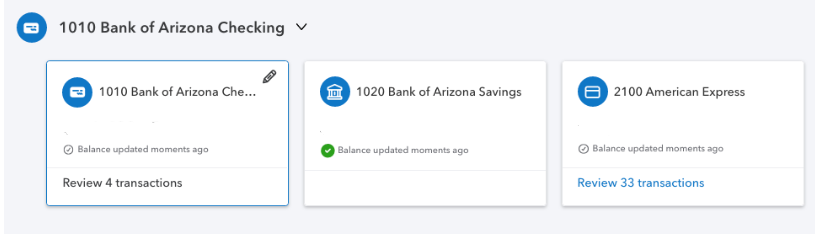

Old Banking Page

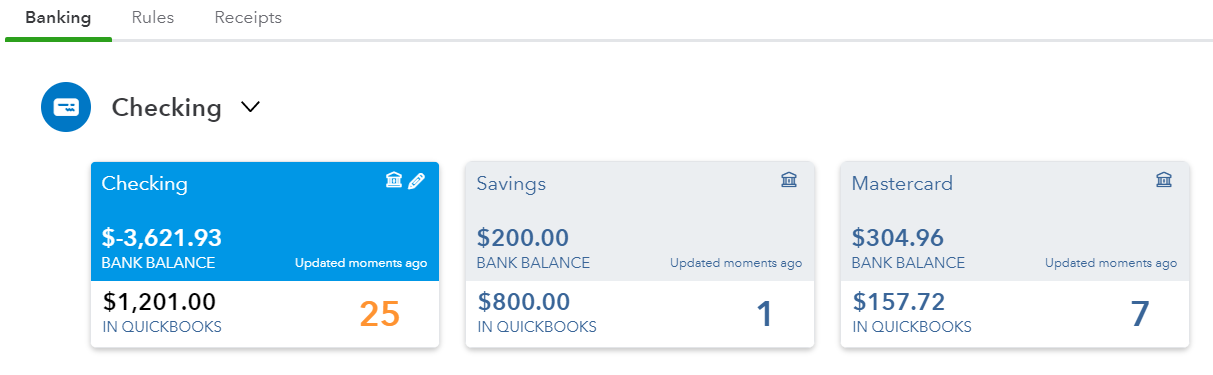

First off, the look of the bank and credit card tiles has changed. The font is a lot smaller; it is so much harder to read. What I have always loved about QBO over QuickBooks Desktop is the use of large fonts, so this is an unwelcome change.

The active tile is just outlined in a thin blue line instead of the having the Bank Balance info highlighted in blue.

The number of transactions to review is much smaller.

There is no differentiation between the In QuickBooks balance and the Bank Balance. It is not clear which balance is even being displayed here.

New For Review Grid

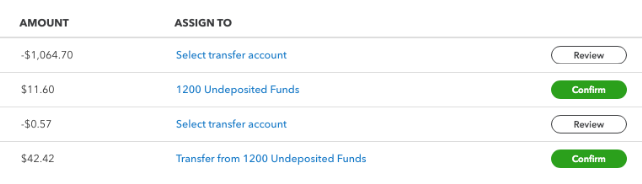

Seconly, under the tiles in the For Review section, there have been significant changes, too. While I like the bigger buttons in the Action column (notice how the column title has been removed), their new titles are confusing. The Confirm button especially will cause problems because the Assign To account suggested by QBO is probably wrong. The first reaction is to just click on this button when in reality, the downloaded transaction should be reviewed. I believe the Review button is suggesting an account previously used when adding a downloaded transaction. Both the Review and Confirm buttons really require the same actions from the user: to click and review the correct account, previously known as Add.

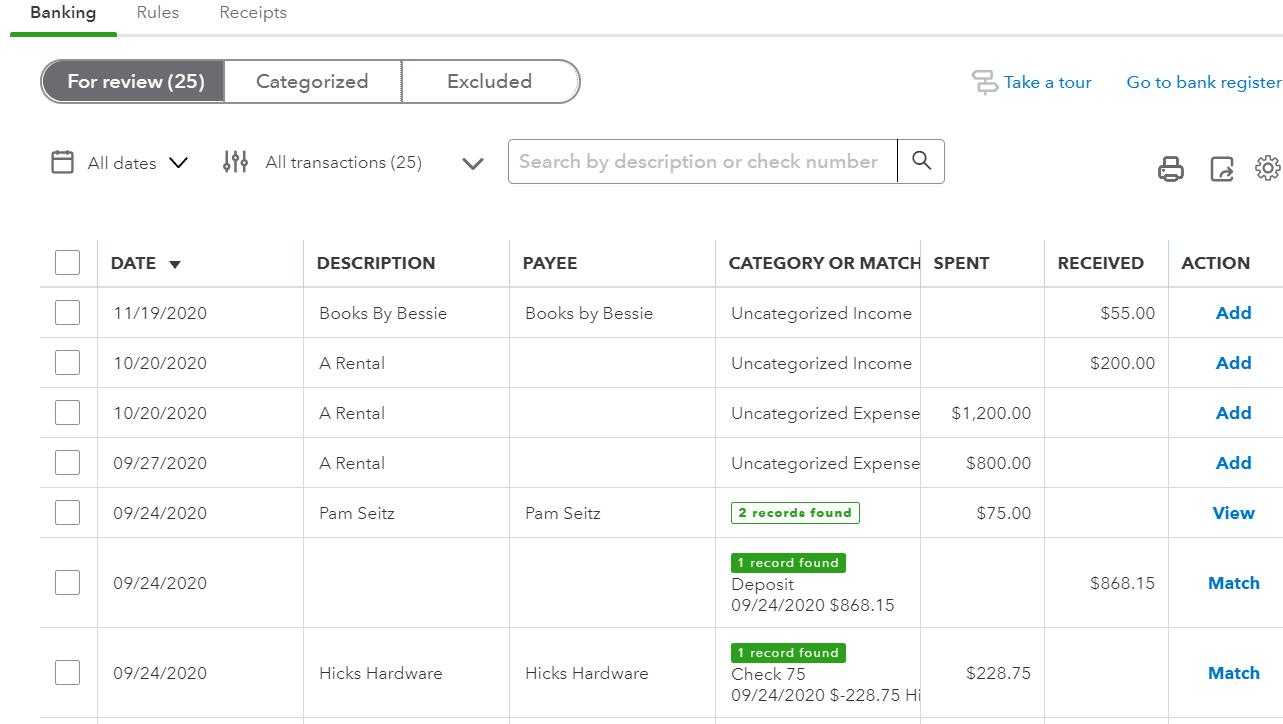

Old For Review Grid

Match has glaringly changed too. It has been replaced with the Review button with the number of records found under Category Or Match column, but not highlighted or outlined, making it easier to miss. The word Match made more sense because it confirmed that only one transaction already in QBs matches the one downloaded from the bank or credit card. The old action View meant that there was more than one transaction already in QBs and that you have to click on the transaction to view the drawer that shows the list of transactions that are potential matches to select from.

What you can do

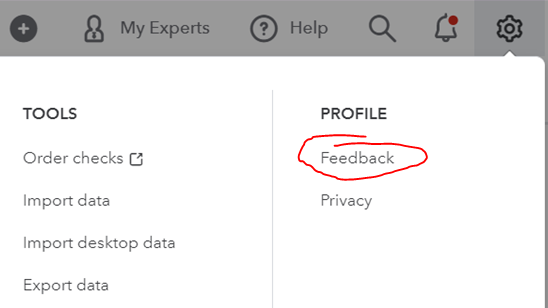

It is not clear whether these are temporary changes or test situations imposed on a select group of accounts or indications of what updates are coming for all QBO accounts. If the latter, I suggest that all QBO users submit feedback to prevent these changes from being implemented. This can be done via the Gear icon and Feedback under Profile. For those accounts that already have these changes, I suggest submitting feedback also so that these updates get rolled back to the older version. Intuit takes feedback submitted this way very seriously.

How to submit feedback